by California Casualty | Homeowners Insurance Info |

For homeowners looking to improve their abode, going the DIY route is tempting. It can save you money, allows for customization according to your needs and style, and can provide a sense of accomplishment and creativity.

That said, some renovation projects are best left to the experts. If you’ve got a project in mind, take a look at the following considerations to help you determine whether to hire out or do it yourself.

Questions To Consider:

What’s your skill level? In the age of YouTube, almost anyone can become a (near) master at anything. Depending on your project, you can find a ton of educational resources online to shore up the required skills and many times even the step-by-step instructions. Be honest in assessing your skills — if you feel comfortable and confident, great; if you feel out of your comfort or learning zone, look at hiring a professional.

Do you have stick-to-itiveness? All home reno projects are exciting in the “dreaming” and initial action phases, but do you have the patience to slog through the hard work and inevitable challenges? Multiple runs to the hardware store in a single day? Broken tools? Miscalculations of supplies or measurements? Maybe tackle a small project or two to test your longevity muscle.

How much time do you have? Try to gauge how much time your project will take (add a buffer of 20% or so), and realistically look at your available time. Evenings and weekends might be the quick answer, but remember you have a life and need downtime too. Also, think about the risk of a project dragging out unexpectedly. If your free time is tight or the family calendar too hectic, a professional contractor will save you sanity.

Is the project complex or dangerous? If your project involves asbestos, gas, electricity, or plumbing — or a mistake could cause serious consequences or harm — it’s best to go with a pro. Reputable contractors carry insurance and are current on all safety risks and requirements. They also have the expertise to advise you on any complicated aspects of the project, such as permitting, regulations, zoning, or structural issues.

Have you crunched the numbers? Usually, cost savings is a main factor for people going the DIY route. However, it’s smart to get a few estimates from professionals anyway and compare them to the DIY costs you’d rack up in materials, tools, and time. Don’t overlook opportunity cost — the time you could spend doing other important things in your life. And remember that for some materials, contractors can secure much better prices (or selection) than consumers.

Is good enough … good enough? Can you live with the end result not being absolutely perfect? Visible paintbrush lines? Tiles not quite even? A crooked cupboard? If so, DIY might be for you; if not, start asking around for professionals known for high-quality work.

Do you mind getting dirty? The majority of home remodeling is the demo work. It’s grueling, dusty, dirty, and messy. If you’re okay with that, more power to you on your DIY journey!

Here are some typical home renovation projects and whether they’re most suited to DIY homeowners or professionals. Many times, it boils down to question 4 above — the level of danger, expertise or complexity.

DIY:

-

- Update kitchen cabinet front panels

- Update interior door knobs or cabinet handles

- Fix or Install a toilet0

- Hang drywall

- Paint interiors

- Install laminate flooring

- Change a ceiling light

- Install baseboards

- Replace tile grout

- Replace tiles

Hire a Pro:

-

- Remodel bathroom

- Remodel kitchen

- Install hardwood or tile flooring

- Side the house

- Remove lead paint

- Make major structural repairs

- Replace windows

- Pave a driveway

- Repair or replace roofing

Sprucing up your home can improve its functionality, increase your property value, and boost your mood. Being thorough in comparing a DIY versus professional approach can help you come to the best decision for you and your family.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Warmer weather is on the horizon and you know what that means? it’s time to break out the gas and charcoal and grill up some juicy meals! But even grilling comes with its fair share of hazards. A small grill fire could easily lead to a home in flames. In fact, on average 10,200 house fires are started by grills each year, which estimates to be about a combined $37 million in property loss.

So, whether you are grilling for enjoyment, to host family and friends, or just for that savory flavor of summer, follow these simple grilling safety tips to help prevent a house fire:

1. Grill at least 10 feet from your home or garage

The farther away from any structures or home decor the better

2. Do not grill under any overhangs or structures

This includes branches, wires, carports, awnings, etc.

3. Do not leave your grill unattended

It only takes one minute for a fire to double in size

4. Turn on your grill and light your gas right away

Don’t wait, if the gas builds up it can cause an explosion

5. Make sure your grill is not leaking

Test it! Spray your tank with soapy water, if the water bubbles, you’ve got a leak

6. Keep your grill clean

Caked-on grease acts as fuel and will only make a fire stronger

7. Do not put too much food on at once

-Dripping fat will only make the flames stronger

8. Keep water or an extinguisher close by-

If a small fire were to start, you can catch and extinguish it at the source

9. Never grill indoors

A spark or flare-up could easily catch something on fire, plus grills release carbon monoxide, which can be deadly

10. Let your grill completely cool off before moving or covering it

Wait 2-3 hours after use and touch it with your hands, if it is still warm, then wait another 2-3 hours before moving or covering

While you’re enjoying your burger, all it takes is one ember on a cooling, unattended grill to bring your whole home down in flames. Have peace of mind knowing that should anything happen, your home will be protected by the proper homeowner’s insurance coverage.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

According to the National Weather Service, drought conditions are expected to persist through the summer across many western states. If you’re a homeowner in a drought-prone area, that means monitoring water usage, thinking ahead to fire prevention and safety, and maintaining landscaping with drought tolerance in mind.

But there’s one more thing to think about: your foundation.

Drought threatens the integrity of your home’s structure in many ways and can end up costing tens of thousands in foundation repairs if problems are not caught early. Here are some of the most common signs of foundation stress or damage, and what you can do about it.

What’s Going On Under Your House?

When dry conditions persist, the soil under your home can lose enough moisture that it shifts and buckles, causing your foundation to crack. When rain finally returns, the soil soaks it up and expands, lifting up your foundation again, which can cause more cracking or unevenness. If your home, like most, has tree roots under it then the roots can draw moisture from the soil, adding to the problem.

Signs You Have a Problem…

A cracking foundation can cause a domino effect of problems up through the house. Here are some signs you might have issues.

-

- Cracks in rigid wall surfaces such as brick, concrete, stucco, tile, and drywall

- Windows and doors that begin sticking or become misaligned

- Leaks in the basement

- Broken pipes

- Gaps along cabinets, baseboards or outdoor trim

- Misalignment where your foundation meets an exterior wall

- Floors that sink or slope

- Cracked basement floor

- Cracked or shifted chimneys

- Cracked asphalt and pavement on driveways or walkways

What To Do About It

Do a careful inspection of your home inside and out. If you see cracks, take photos, measure, and record them so you have a history to compare with in the future. If the cracks are minor or few, just keep an eye on them. If you see anything serious or worrying, contact a professional. You want to prevent any foundational issues before they cause serious (and expensive) damage. Here are some preventive measures you can take to keep the ground under your home moist:

-

- Install a water system around your home.

- Add a few inches of mulch to your landscaping area.

- Plant drought-tolerant and fire-resistant shrubs and groundcover, which will hold moisture in the ground and keep it shaded, preventing evaporation.

- Keep up with weeding (weeds are thirsty).

- Plant any new trees far enough from the foundation to keep roots at a distance.

- As always in drought-prone areas, practice water conservation inside and outdoors.

Catching foundation problems before they get serious entails some extra time and attention on your part but will help you avoid costly repairs or even replacement of your foundation.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Did you know that many of the homes destroyed by wildfire actually caught fire from within the structure? This is because embers made their way inside the house through vents, windows, chimneys, or other openings.

Embers can travel more than a mile out ahead of the main fire body, igniting any dry fuel or easily ignited materials in their path. If they land on or become lodged in combustible materials on, in or near your house, they’ll gain a toehold and ignite.

To protect your home from an ember attack this fire season, check its exterior and perimeter for vulnerabilities, then fix, replace, adjust and clean as needed.

The First Line of Defense: Stop the Embers From Entering

Once an ember gets into your home it can burn out of control incredibly quickly. Block entry points by inspecting the following.

Vents – Install 1/8th inch metal mesh screening on attic, foundation, and eave vents to prevent embers from being sucked into your home.

Roofs – Replace wood shingles with non-combustible or fire-resistant roofing. Repair or replace any loose tiles and plug any openings.

Gutters – Remove dry fuels (dead leaves, pine needles, debris) from gutters and roof.

Siding and Trim – Caulk any gaps and replace materials as needed. Fire experts recommend having 5-6 inches of exposed concrete at the base of your house, rather than having siding reaching all the way to the ground where it’s vulnerable to embers. Finally, if you’re in a fire-prone area, consider fire-resistant siding or treatments.

Eaves – Eaves can be an entry point of fire getting into your attic. Cover them with sheathing and use fire-resistant materials where possible. Use tightly fitted joints (such as tongue and groove) instead of butt joints.

Chimneys and Stovepipes – Block out embers by installing a spark arrestor.

Skylights – The safest are double-paned glass, and one of the panes should be tempered glass. Replace any plastic skylights. If the fire is threatening, close skylights.

Windows – Replace non-tempered, single-pane windows with tempered, multi-paned glass. As with skylights, close all windows if a fire is possible.

Garage Door – Close doors as tightly as possible to prevent embers from entering. Consider using trim around the garage door opening to reduce gaps. Be sure the door is closed if there’s a chance of fire approaching.

The Second Line of Defense: Your 0-5 ft Perimeter

If an ember lands on dry, combustible fuel right at the edge of your home, it can spark a structure fire in seconds. Minimize those chances by looking at the following.

Decks and Porches – Repair or replace decayed materials and use metal flashing between the deck and house. Remove anything stored underneath the deck, as well as debris between deck boards or where it meets the house.

Patio Furniture – Move furniture and any other combustible items on your patio to the garage.

Flowerboxes – Remove if a wildfire is active in your area.

Wood Piles – Keep firewood stacks at least 30 feet from your house and other structures.

Propane Tanks – As with firewood, keep tanks no closer than 30 feet from structures.

Vehicles – Close all windows and back into the garage, or park well away from the house.

Mulch Around the Home – Mulch is flammable, so replace it with rock or gravel where it’s close to your home.

Branches and Shrubs – Make sure all are trimmed back. Replace flammable plants wherever possible.

Fortifying your home against embers is one important step in prepping for fire season. Download our checklist for fire readiness and creating a 100-foot defensible space around your home.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

While you’re finalizing your summertime plans for vacation, road trips, and or weekend getaways, thieves and burglars are just getting started on their busy season.

Read on to learn how to protect your home and car from break-ins this summer.

Home

Contrary to TV dramas, most burglaries take place during the day, between 10 am and 3 pm. They’re more frequent in the summer months than any other season, and the average dollar loss is around $2,000. The most commonly stolen items during a break-in include cash, jewelry, medications/drugs, guns, and electronics. Here are some ways to protect your home against intruders while you’re away.

- Make It Look Like Someone’s Home – Set interior lights on timers. Keep up your lawn/landscaping care schedule. Put a hold on newspaper and mail delivery. Close blinds in rooms where expensive items, such as TVs and other large electronics, might be visible.

- Don’t Share On Social Media – Resist putting your upcoming travel plans on social media. The same goes for voicemail, answering machines, and email autoreply. If you can’t help posting on social, keep the dates vague and make sure that your posts are only shared with (close) friends.

- Be Lock Savvy – Remove any spare keys on your property (burglars know where to look). Do a thorough check to make sure the locks work on all windows and doors — and make sure you lock everything before leaving. Finally, lock the garage as well as your car inside it!

- Tap Your Neighbors – Depending on how long you’ll be gone, consider asking a trusted neighbor or friend to check in on your home periodically. They can check for signs of attempted entry, landscaping issues, or other damage. Inside your home, they can adjust blinds and shift furniture a bit to convey human presence.

- Install an Alarm System – It may be worth getting an alarm system. Be sure to put alarm signs in the front and back yard (the latter is where most intruders enter premises). Make sure to let your alarm company know when you’ll be out of town, and that they have an updated list of contacts and numbers.

Auto

It’s time to hit the road — for road trips, weekend trips and day hikes. Here are 5 simple ways to reduce the risk of a break-in while you’re away from your car.

- Lock It – This goes without saying, but do make sure to lock all doors, including the trunk, and make sure all windows are rolled up. Sometimes key fobs misfire, so it’s best to do a manual check of your doors. If you’re traveling with kids, double-check their windows in case they rolled them down.

- Hide Valuables – If possible, leave nothing of value in the car anywhere. Any visible items — even loose change or phone charging cords — increases the risk of a break-in. If that’s not possible, bring what you can with you in a purse or day pack, and/or stow them away in your car (in the glove box, under a seat, stashed in the trunk, etc.). Make your car look as tidy and sparse as possible before locking and leaving it.

- Park Smart – Be aware of your chosen parking spot’s surroundings. Parking garages tend to be safest. On the street, avoid areas that have broken glass near the curb. Choose a spot near other parked cars, in a well-lit and busy area.

- Consider an Anti-Theft Device – If your car didn’t come with one, you may want to install an audible alarm system, which emits a loud noise when someone attempts to enter. Other devices include steering wheel locks (an old standby that’s very affordable), wheel locks, brake locks and tire locks. There are also higher-tech solutions such as GPS-enabled tracking systems.

- Take the Spare – Thieves know where to look for spare keys, so be sure to always take all keys with you.

Nothing ruins a summer adventure like a break-in. Taking some smart steps beforehand to protect your home and car will pay off with peace of mind and fond summer memories.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

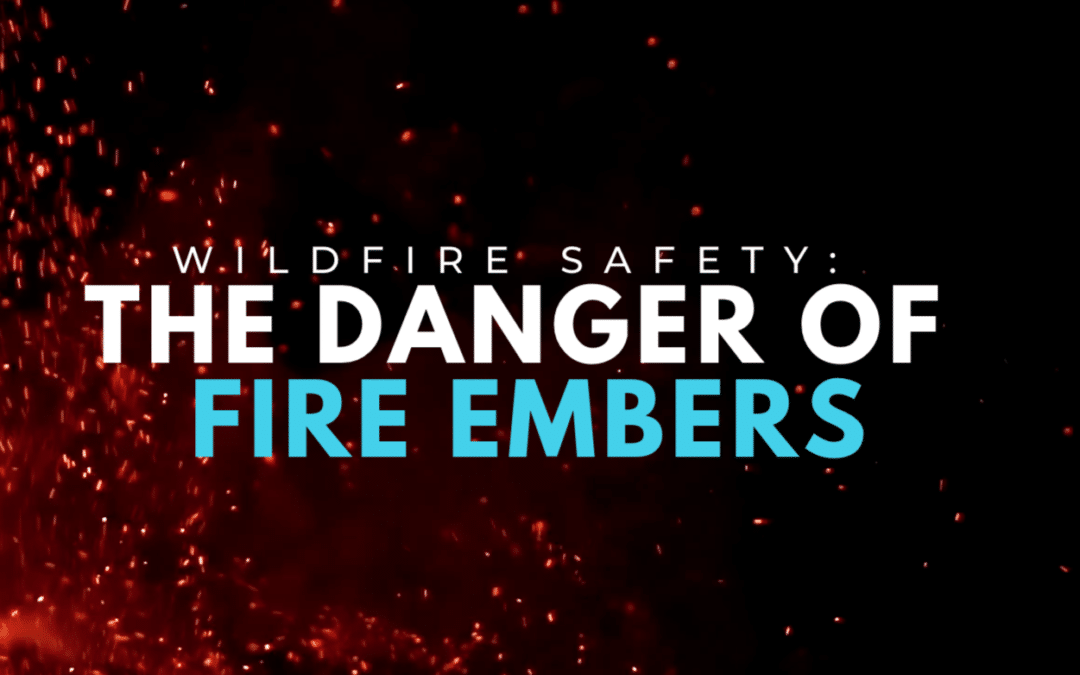

Although it is recommended to review your home and auto insurance policies yearly, 60% of all Americans are underinsured and/or don’t understand their policies. Do you know what’s really covered with your insurance policy?

If you don’t or you have any doubts, now is a great time to get an annual review of your auto and home/renters insurance policies. You’ll sleep better at night knowing you are protected against expected surprises if you have a claim. You may also find you are eligible for additional savings and discounts!

Here are seven examples of why you should contact your insurance advisor to review your policy:

- You got married. Newlyweds often pay less for insurance than when they were single. You can also find discounts by combining your autos with one insurance company. It also means all those expensive wedding gifts you received might need extra protection.

- You got divorced. You probably are no longer sharing a vehicle and moved into a different residence. You’ll need to inform your insurance company to set up separate auto and home or renters insurance policies.

- Your teen got a driver’s permit or license. You need to let your insurance company know if they are driving your vehicles, or if you bought them one. Make sure that you take advantage of good student discounts and additional multi-vehicle savings!

- You bought or inherited valuables such as antiques, fine art, jewelry or other collectibles. Your standard homeowners or renters insurance policy provides limited coverage of high dollar items. This is a good time to purchase scheduled personal property endorsements to cover your new valuable possessions for a higher amount.

- You’ve added on to your home or have remodeled. Improvements to your house mean there is more to protect. Contacting your insurance company is a good way to make sure that you have enough coverage. This also applies for a new gazebo, shed or pool, or hot tub.

- You’ve moved to a flood or earthquake prone area. Neither earthquake nor flood insurance is included with most homeowners or renters policies. You need to purchase separate flood or earthquake insurance. Keep in mind that flood insurance has a 30-day waiting period before it becomes effective.

- You’ve retired. This often means you are driving less, which could significantly reduce your insurance costs. Drivers over 55 also often get discounts from their insurance companies and you can further reduce your premiums by completing a driver safety course.

Knowing more about your insurance could save you money on your premiums and heartache in the event of a break-in or natural disaster.

If it is time for your auto or home insurance coverage review contact one of our customer care advisors today at 1.800.800.9410. A few minutes of your time will provide the appropriate protection, and we may even find you some extra savings!

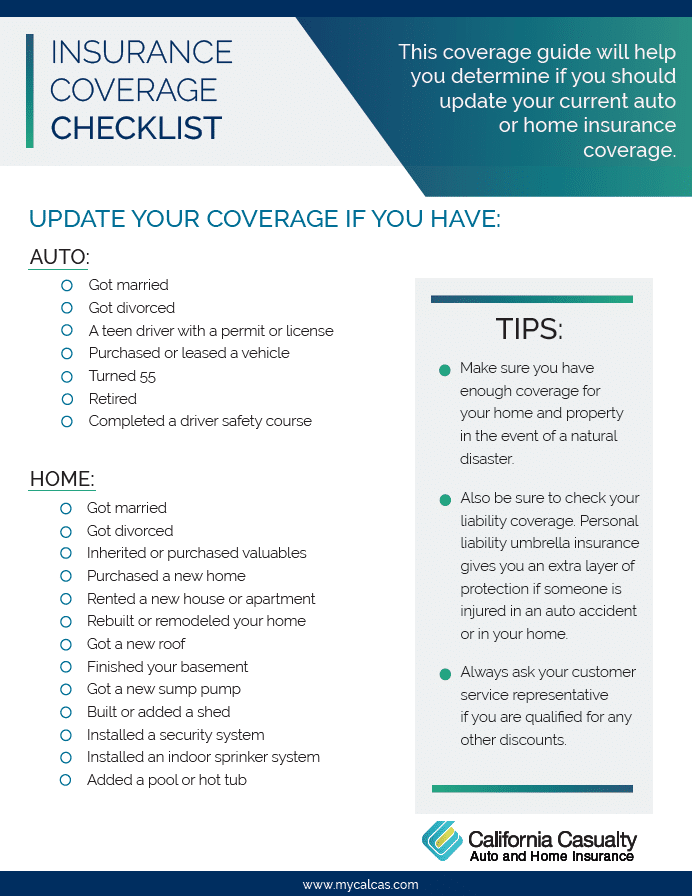

If you don’t know where to start to determine if it’s time for your policy review, download our free Insurance Coverage Checklist. Just click the image below for your free download!