by California Casualty | Calcas Connection |

School Lounge Makeover winner Mary Gregoski (center) with NSEA Representative Jen Dubas and California Casualty’s Stephanie Whitmore enjoying the new Palmer School lounge

Palmer, NE, December 12, 2019 – The staff at Palmer Public School in Nebraska will now have a quiet place to relax and recharge during the school day, thanks to a $7,500 School Lounge Makeover® from California Casualty. The new lounge was unveiled on Tuesday.

“We are very appreciative of California Casualty for providing this for us,” said Palmer Schools’ Superintendent, Dr. Joel Bohlken. “This will make a big difference because we really didn’t have a place for our staff to go for a moment to unwind and relax before heading back to the classroom,” he added.

Palmer English teacher and school librarian, Mary Gregoski, submitted the winning entry for the makeover. “This means we will now have a place of our own to get a short break before we return to the teaching environment. We are just so grateful that California Casualty thinks about educators,” she said.

The new staff lounge at Palmer School features a TV, two massage chairs, soothing “bubble water wall art,” coffee station, new tables, a refrigerator, and colorful paint and accessories. EON Office designers maximized the area for comfort.

The $7,500 School Lounge Makeover giveaway was created to provide educators a more conducive environment to take a break, share time, and revitalize during their long days at school. This is the 13th School Lounge Makeover provided by California Casualty since the program began in 2011.

“We’ve seen the dedication of administrators, teachers, and staff firsthand and we’re proud to show our appreciation,” added California Casualty Sr. Vice President, Mike McCormick.

California Casualty has other giving programs that benefit public schools and educators, including:

- “Keep On Course” safe driving campaign where educators who take a pledge to avoid distracted driving can register to win a new Jeep Compass, WinAJeepCompass.com/NEA.

- $2,500 Academic Award, providing money for educational materials and projects, EducatorsAcademicAward.com/NEA

- Thomas R. Brown Athletics Grants, providing $1,000 to $3,000 to middle school and high school sports and athletic programs in need, calcasathleticsgrant.com

- California Casualty Award for Teaching Excellence, in conjunction with the NEA Foundation, honoring exceptional instructors across the nation, neafoundation.org/for-educators/awards-for-teaching-excellence/california-casualty-awardees/

- $500 New Teacher Shopping Spree, WinWithCalCas.com

- $250 Music and Arts Grants, calcasmusicartsgrant.com

- $200 Help Your Classroom Grants to provide for classroom materials that benefit students, calcas.com/Help-Your-Classroom

Learn more about California Casualty and its giving programs at www.calcas.com/newsroom.

Founded in 1914, California Casualty provides auto and home insurance to educators, law enforcement officers, firefighters and nurses across the country. Headquartered in San Mateo, California, with service centers in Arizona, Colorado, and Kansas, California Casualty has been led by four generations of the Brown family. More information about California Casualty can be found at www.calcas.com

by California Casualty | Calcas Connection |

California Casualty is proud to join the NEA Foundation in congratulating the recipients of one of public education’s most prestigious awards: the 2020 California Casualty Awards for Teaching Excellence. See the entire list at https://www.neafoundation.org/for-educators/awards-for-teaching-excellence/california-casualty-awardees/.

San Mateo, CA, December 11, 2019 – California Casualty congratulates the 45 public school educators named 2020 California Casualty Award for Teaching Excellence recipients.

The awards highlight educators from around the country cited by their peers for their dedication to the profession, community engagement, professional development, attention to diversity and advocacy for fellow educators.

“This year’s awardees are fulfilling the promise of public education in the classrooms, schools, and communities from coast to coast,” said Sara A. Sneed, President, and CEO, the NEA Foundation. “Each awardee has met a very high standard, and together, they are celebrated for a shared commitment to educational excellence, innovative approaches to student learning, and support for their peers. We are grateful to California Casualty for its recognition and celebration of the very best in education, and we look forward to honoring the 2020 California Casualty Awards for Teaching Excellence awardees.”

“We are proud to honor these exceptional educators and show our appreciation for their incredible work,” said Beau Brown, Chairman of the California Casualty Board. “The California Casualty awardees exemplify educators’ ability to be a positive force in their student’s lives.”

Each California Casualty Award for Teaching Excellence awardee’s school will receive a $150 stipend from California Casualty to purchase items to enhance classrooms. The awardees will also participate in the NEA Foundation’s Salute to Excellence in Education Gala, held February 7, 2020 in Washington, D.C. The gala will be live-streamed at neafoundation.org.

The NEA Foundation and the National Education Association jointly present the awards.

More information about the awards and the individual winners is at https://www.neafoundation.org/for-educators/awards-for-teaching-excellence/california-casualty-awardees/.

ABOUT THE NEA FOUNDATION:

The NEA Foundation is a public charity founded by educators for educators to improve public education for all students. Since our beginning in 1969, the Foundation has served as a laboratory of learning, offering funding and other resources to public school educators, their schools, and districts to solve complex teaching and learning challenges. We elevate and share educator solutions to ensure greater reach and impact on student learning. We believe that when educators unleash their own power, ideas, and voices, communities, schools, and students all benefit. Visit neafoundation.org for more information.

ABOUT CALIFORNIA CASUALTY:

California Casualty has been serving the insurance needs of educators since 1951, and is the only auto and home insurance company to earn the trust and endorsement of the NEA. As a result, NEA members qualify for exceptional rates, deductibles waived for vandalism or collisions to your vehicle parked at school, holiday or summer skip payment plans and free Identity Defense protection – exclusive benefits not available to the general public. Learn how to save by getting a quote at www.calcas.com/NEA, or by calling 1.800.800.9410.

by California Casualty | Calcas Connection, In Your Community |

Working with you at schools, higher ed campuses, law enforcement offices, fire stations and hospitals provides us many opportunities to give back. Staff members at our Service Centers, Home Office and our Partner Relations team live in your communities, and we all pitch in to help with various fundraisers and recognition events.

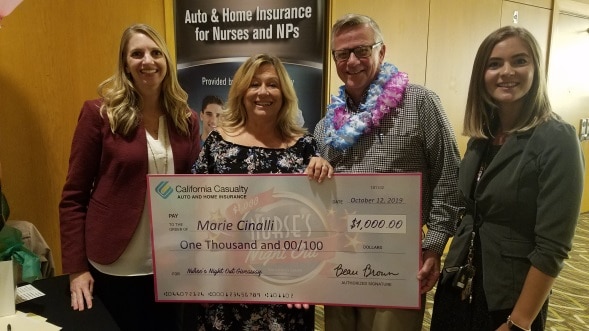

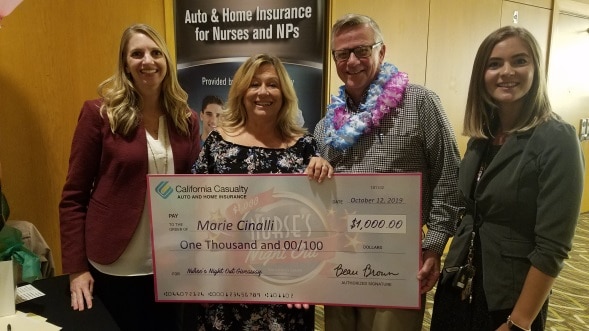

We recently celebrated the extraordinary care that nurses give to others with $1,000 Nurse’s Night Out awards that went to Ohio RN Marie C. and Oregon RN Dina D. Both are members of their respective nurses associations. With holiday shopping and travel, both nurses said the money comes at a great time.

Marie (second from left) receiving her Nurse’s Night Out award

Dina (center) receiving her Nurse’s Night Out award

Our Illinois Field Marketing Manager, Katie Dunn, was given a great honor this fall by the Illinois Firefighters Association. As a token of appreciation for all the dedication she has shown to IFA and their members’ safety, they presented Katie with a white helmet naming her an honorary fire chief of the IFA. “Katie is always there to support the IFA in its efforts to make the fire service better for the men and women who wear the uniform,” remarked Terry Ford, VP of the IFA. “Her tireless energy, dedication and willingness to help with IFA programs and events demonstrate her caring for our members.”

Our Illinois Field Marketing Manager, Katie Dunn, was given a great honor this fall by the Illinois Firefighters Association. As a token of appreciation for all the dedication she has shown to IFA and their members’ safety, they presented Katie with a white helmet naming her an honorary fire chief of the IFA. “Katie is always there to support the IFA in its efforts to make the fire service better for the men and women who wear the uniform,” remarked Terry Ford, VP of the IFA. “Her tireless energy, dedication and willingness to help with IFA programs and events demonstrate her caring for our members.”

Alina with Louis Manzione, President of the Independent College Fund of New Jersey

Another prestigious honor was given to Accounts Relations Manager Alina Fayerman. Alina works incredibly hard for the New Jersey groups that California Casualty serves and was named this fall to the Board of Trustees of the Independent College Fund of New Jersey. Alina, who received a scholarship from the fund when she attended Drew University, will actively give back by helping with marketing expertise and support for the state’s independent colleges and universities.

California Casualty employees also participated in charity events, giving back to their communities. One was the very moving “Out of the Darkness” walk to prevent suicide. California Casualty Senior Field Marketing Manager, Sherry Hanacek, joined hundreds of people on a drizzly, cold September morning. She was supporting past president of the Oregon Volunteer Firefighters Association Dave Butler and his wife, Anita, who suffered the loss of their son. Dave organized the walk, which raised more than $20,000 for the cause.

At our Colorado Springs Service Center, the November fundraiser was for Silver Key Senior Services. Every day can be difficult for elderly shut-ins, but the holidays can be especially tough. Hundreds of pounds of food, kitchen necessities, and personal care items (enough to fill a pickup truck) were collected and donated to help seniors in need. The donations will supplement Silver Key’s food pantry and home-delivered meals program.

And through our many visits to schools across the nation, we created a new Music and Arts Grant program to aid creativity in schools, such as choir, band, dance, film, theater, computer arts and graphics, or any K-12 curriculum that employs art for learning. After we reviewed nearly a thousand applications, 139 public schools in 31 states received a total of $34,000 to help provide music, instruments, and art and performance necessities. Some of those included:

- Purchasing special adaptive instruments for the Special Education Center at Mark Twain School in Garden Grove, CA, that serves special needs and medically fragile students

- Supplying watercolor sets for third-grade students at Homer Davis Elementary School in Tucson, AZ

- Reestablishing the art program to third graders at Arcadia Elementary School in Deer Park, WA

- Providing adaptive instruments and technology to expand the music therapy program for students at the ACES Village School in North Haven, CT

- Buying an additional camera to allow more students to participate in the photography program at Filer High School in Filer, ID

The entire list of Music and Arts grantees can be found at www.calcas.com/-/2019-music-and-arts-grant-recipients.

Public K-12 schools needing funding for an arts or performance program can apply for the 2020 Music and Arts Grant from California Casualty at www.calcasmusicartsgrant.com.

TAKEAWAY: Follow the many ways California Casualty celebrates all that you do at our Facebook page, www.facebook.com/CaliforniaCasualty.

Read Next:

How We’re Listening and Learning From You

Ways To Protect Your ID When Shopping Online

Here’s Free Help If You’re A Victim Of ID Theft

by California Casualty | Calcas Connection, Good to Know |

Many of us will be using smartphones and laptops for our holiday shopping. While it may be more convenient than a drive to the mall, going online presents dangers to your credit and personal data. Cyber-crooks are lurking, just waiting for a slip-up to steal your identity and get into your bank and credit card accounts. As you tap in and surf for deals, be cautious about where you go and the information you give others. It’s estimated that one-in-five Americans have been a victim of identity theft, and 43% of those had their identity stolen while shopping online during the holidays.

Be Secure

It’s more important than ever that you protect your personal information. Here are some important internet shopping safety tips to remember:

-

- Don’t open suspicious or unsolicited emails that can often take you to dangerous sites

- Shop with familiar companies, looking for the secure “https” in the URL (“S” indicating it is a secure site), and beware of copycat sites with slight misspellings

- Use strong, unique passwords for online accounts

- Avoid using debit cards and pay with a credit card for online shopping (credit cards offer the most fraud protection)

- Refrain from shopping or banking while using free or public Wi-Fi

- Be aware of fake charity, pet adoption and lonely-hearts solicitations

- Check your credit card, bank and other accounts often for suspicious or fraudulent charges

- Never send a gift card for payment (a trick many crooks use)

If you are planning on giving to a charity, you also need to take your time and do research to make sure your donation goes to a good cause. Scammers know that people’s good hearts make them easy targets for rip-offs. Remember to:

-

- Be skeptical of email solicitations from charities you have never heard of or supported before

- Avoid giving to any organization requesting gift cards, wiring money, or transferring funds to an overseas bank

- Realize that many social media donation sites may not be legitimate

- Seek out each charity’s authorized website (crooks often use sound-a-like sites and misspellings)

- Check the legitimacy of charities through sites such as the Better Business Bureau, Charity Navigator and GuideStar

Resolution

If you suspect that you have been an ID theft victim, the Federal Trade Commission recommends:

-

- Placing a freeze on your credit report (locking down your credit to anyone)

- Placing a fraud alert (protecting your credit from unverified sources) with one of the three nationwide credit bureaus (Experian, Equifax and TransUnion)

- Filing a complaint with the Federal Trade Commission

Find more ID theft protection information https://mycalcas.com/?s=cyber+crooks.

TAKEAWAY:

One of the many benefits that California Casualty offers with every auto and home/renters policy is free ID theft resolution services from CyberScout. Learn more at www.calcas.com/identity-theft or call 1.800.800.9410, option 3 to learn more.

Read Next:

How We’re Listening and Learning From You

Here’s Free Help If You’re A Victim Of ID Theft

We’ve Got The Heat To Help, And Love Giving Back

by California Casualty | Calcas Connection, Consider This |

When you purchased a California Casualty insurance policy, you received a valuable gift – free help if you are ever a victim of identity theft.

We realize that almost every stage of your life-journey can put you at risk for ID theft. From getting married, purchasing a new home, going to the hospital or registering children for school, your personal information can be grabbed by identity thieves and fraudsters.

When your personal identity has been taken, it takes an emotional toll and can cost thousands of dollars and many hours to resolve. The sooner you react, the sooner you can start regaining your good name and re-establishing your credit.

Having a trusted company walking with you can make all the difference. That’s why California Casualty offers free ID theft resolution services from CyberScout.

CyberScout is the nation’s premier provider of identity services, providing these services (and more):

- Tax fraud support

- Financial identity theft

- Utility identity theft

- Payday loan identity theft

- Document replacement and break-in theft support

- Travel identity theft

- Child identity theft

California Casualty started offering the ID theft resolution services offered by CyberScout in 2006. At that time, few companies offered this type of help to customers, and many of those who did charge a fee. California Casualty wanted to make certain that all customers would receive identity theft resolution services at no charge and to make the process as simple as possible. Customers simply call the toll-free number for California Casualty, where a Customer Service representative verifies their policy and transfers them to CyberScout. CyberScout assigns a personal fraud specialist who works with our customers until the fraud problem is resolved. That means you have unlimited one-on-one access to a dedicated fraud specialist who will assist you in understanding credit reports, gathering evidence against the fraudsters, working to limit damages, and following up to make sure the problem has been cleared up.

With insurance from California Casualty, if you or a loved one’s personal information is compromised, you can rest assured that a CyberScout fraud specialist will get in the trenches to help speed the recovery process – placing fraud alerts, contacting creditors and sticking with you as long as it takes to restore your good credit.

CyberScout has actively helped 17 million households across the world with data theft resolution and education. Their testimonials say it all:

“We are very pleased with the help received after our credit cards and ATM card were compromised. We feel more secure after our CyberScout advisor’s help and advice.”

“My fraud investigator was an angel. She answered all my questions, assisted with calls and letters to retailers, assisted with a seven-year credit freeze and followed up with all closed accounts. She is truly knowledgeable, friendly and compassionate.”

If you fear you have been a victim of identity theft or an account takeover, you can take solace that you have the expertise of CyberScout, provided by California Casualty, to help you battle the criminals and restore your peace of mind.

TAKEAWAY:

Learn more about the FREE identity theft protection from CyberScout that comes with your insurance policies from California Casualty at www.calcas.com/Identity-Theft, or contact a customer care specialist at 1.800.800.9410 option 3.

Read Next:

How We’re Listening and Learning From You

Ways To Protect Your ID When Shopping Online

We’ve Got The Heart To Help, And Love Giving Back

by California Casualty | Behind the Scenes, Calcas Connection |

Your satisfaction is very important to us. We want to work better for you, and we’re asking you to help us accomplish that goal.

For years, we have been measuring your customer service experience, and you have repeatedly given our Customer Service team a 99% satisfaction rating. The Service team celebrates when you tell us that we are meeting your expectations. When you say that we didn’t, they have reviewed their procedures, resulting in new programs, such as our call-back option to avoid long hold times during high call volumes, along with more online opportunities to manage your policies.

You’ve also aided our Claims department, which has implemented new technology to accentuate your customer experience. A major improvement has been the new electronic transfer of funds, providing customers much quicker financial assistance when there is a claim.

We feel it’s crucial that we maintain that level of service, and your insight is invaluable. That’s why California Casualty offers ongoing surveys to customers like you. What you think about what we are doing right, and where we fall short, makes a difference. All the feedback you provide is added to our Net Promoter Score.

The Net Promoter Score helps us stay focused on what you think is important. We review and share your open-ended comments with all levels of the company. You give us a benchmark of what we do right over time, and your constructive criticism helps effect change that benefits customers.

So far, we have completed 15 Net Promoter Score surveys.

“While the trend in the score over time gives some directional information, the real value of the survey is the specific written comments we receive. These highlight the things that we do well, but also show some of the interactions where we could have improved,” said California Casualty CEO and President, Joe Volponi.

Many of those sentiments from the Net Promoter Score are echoed in California Casualty’s Trustpilot reviews. Free and open to all, Trustpilot is considered the most powerful review platform with a mission of bringing people and companies together to create ever-improving experiences for everyone. Trustpilot has recorded more than 71 million reviews, connecting consumers to businesses and improving business engagement and collaboration with consumers.

Your 1,456 reviews of California Casualty on Trustpilot have provided us a real-time measure of what you are thinking. While a majority have been positive, others have assisted us in fixing areas where we fell short in giving you the ultimate customer experience. We invite you to read our Trustpilot reviews and give one of your own at www.trustpilot.com/reviews/calcas.com.

While more than 90% of you have told us that you would recommend California Casualty to family members or colleagues, we still are not satisfied.

We have recently added new ways to measure how we are living up to our promise to give you a great customer experience.

We are now asking you to take a short survey after talking with a Customer Service advisor, determining if we resolved your issue and if you would refer us to others. We are also asking anyone who contacts our Sales team if they were satisfied and if we met their expectations.

If you took part in one of these surveys, thank you.

Engaging with you – listening and learning – is all part of our effort to deliver the best insurance experience that our valued customers and group partners deserve. You work hard to make our communities better, and we appreciate all that you do.

We are an insurance company that cares. That means we are part of people’s lives when the worst happens, and how we handle the task is what makes us different.

TAKEAWAY: Please help us improve by completing the survey offered after contacting California Casualty. You can also find our Trustpilot reviews and connect with us via social media at our blog page, www.mycalcas.com.

Read Next:

Ways To Protect Your ID When Shopping Online

Here’s Free Help If You’re A Victim Of ID Theft

We’ve Got The Heat To Help, And Love Giving Back

Our Illinois Field Marketing Manager, Katie Dunn, was given a great honor this fall by the Illinois Firefighters Association. As a token of appreciation for all the dedication she has shown to IFA and their members’ safety, they presented Katie with a white helmet naming her an honorary fire chief of the IFA. “Katie is always there to support the IFA in its efforts to make the fire service better for the men and women who wear the uniform,” remarked Terry Ford, VP of the IFA. “Her tireless energy, dedication and willingness to help with IFA programs and events demonstrate her caring for our members.”

Our Illinois Field Marketing Manager, Katie Dunn, was given a great honor this fall by the Illinois Firefighters Association. As a token of appreciation for all the dedication she has shown to IFA and their members’ safety, they presented Katie with a white helmet naming her an honorary fire chief of the IFA. “Katie is always there to support the IFA in its efforts to make the fire service better for the men and women who wear the uniform,” remarked Terry Ford, VP of the IFA. “Her tireless energy, dedication and willingness to help with IFA programs and events demonstrate her caring for our members.”