by California Casualty | Auto Insurance Info, Helpful Tips, Safety |

When it comes to keeping you safe behind the wheel, nothing works harder than your brakes. They’re your car’s first line of defense against accidents, yet most drivers don’t think about them until something goes wrong—a squeak, a grind, or that sinking feeling when the pedal doesn’t respond like it should.

The good news? You don’t need to be a car expert to understand how brakes work or how to spot trouble before it turns into a safety issue. With a little knowledge, you can keep your brakes in top shape and give yourself peace of mind every time you drive.

How Do Brakes Actually Work?

At their core, brakes use one simple idea: friction. When you press your foot on the brake pedal, you’re triggering a hydraulic system—a system powered by fluid—that pushes brake pads or brake shoes against a spinning surface attached to your wheels. That pressure and friction are what slow your car down.

Think of it like riding a bicycle. When you squeeze the hand brakes, the pads press against the rim of the wheel, creating friction that makes the bike stop. Your car brakes work on the same principle, just on a larger and more powerful scale.

Most modern cars also have power-assisted brakes, which make it easier for you to press down, and an anti-lock braking system (ABS), which prevents the wheels from locking up during sudden stops. That keeps your car more stable and easier to steer in an emergency.

Disc vs. Drum: The Two Main Types of Brakes

Most vehicles on the road today use a hydraulic braking system with either disc brakes, drum brakes, or a combination of both.

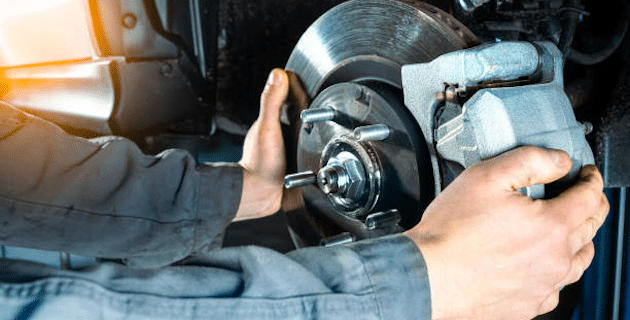

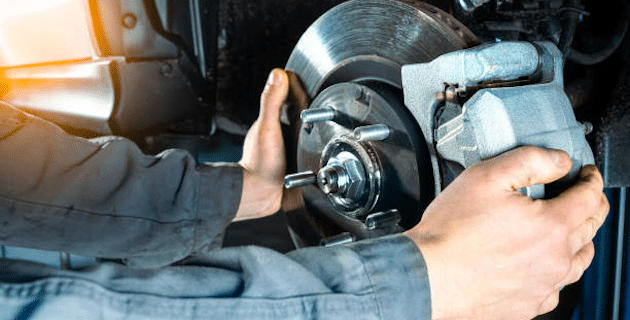

- Disc Brakes: These are the most common, especially on the front wheels (which handle most of the stopping power). A spinning disc, called a rotor, is clamped by a caliper holding brake pads. When you press the brake pedal, the pads squeeze the rotor, creating friction to slow the wheel.

- Drum Brakes: These are more often found on rear wheels. Inside the brake drum, brake shoes are pressed outward by pistons when you hit the brakes, rubbing against the drum to slow the car.

You don’t need to memorize the mechanics, but it helps to know that both systems rely on brake fluid, pads or shoes, and the principle of friction to get the job done.

Warning Signs Your Brakes Need Attention

Brakes give you plenty of signals before they fail completely. The key is to notice them early:

- Strange Noises: A squeal often means your brake pads are wearing thin. A grinding sound could mean the pads are worn down completely, with metal scraping against metal.

- Soft or Spongy Pedal: If the brake pedal sinks toward the floor or feels unusually soft, it may signal a leak in the brake system or air in the brake lines.

- Car Pulling to One Side When Braking: If your vehicle veers left or right when braking, it could be uneven brake wear, contaminated fluid, or a problem with the brake linings.

- Dashboard Warning Lights: Don’t ignore that glowing brake light. It’s your car’s way of asking for help.

If you notice any of these symptoms, it’s time to schedule a brake check before things get worse.

Simple Brake Maintenance Tips

You don’t need to be a mechanic to stay on top of basic brake care. A little attention can go a long way toward preventing costly repairs and keeping you safe. Here are some practical steps:

- Check Brake Pads: Brake pads wear down over time. If they’re less than ¼ inch thick, it’s time to replace them. Worn pads reduce your stopping power and can damage other parts of the braking system.

- Watch for Grease or Debris: Brake pads should be clean and dry. Grease or oil on them can reduce friction, making it harder to stop.

- Brake Fluid: Your mechanic should check the level and condition of your brake fluid regularly. Fresh brake fluid is clear or light in color. Dark or dirty fluid should be replaced.

- Rotors and Drums: Look for signs of grooves, cracks, or warping. Depending on the severity, they may need to be resurfaced or replaced.

- Brake Lines: Over time, brake lines can develop leaks from corrosion or damage. Any leak in the system reduces braking power and must be fixed immediately.

A good rule of thumb is to have your brakes inspected at least once a year—or sooner if you notice any changes in how they feel or sound. The cost of regular maintenance is small compared to the expense (and stress) of major repairs, not to mention the potential consequences of an accident.

Brakes may not be the flashiest part of your car, but they’re among the most important. Knowing how they work, spotting warning signs early, and keeping up with maintenance can give you confidence on the road and keep you—and your passengers—safe.

Of course, even the best brakes can’t prevent every unexpected situation. That’s where the right insurance comes in. Just as your brakes protect you in the moment, good coverage protects you afterward—helping you recover from accidents, repairs, or losses. Together, brake care and the right insurance give you the peace of mind to enjoy the drive, knowing you’re fully protected.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Helpful Tips |

Your car’s fluids are like its lifeblood—without them, things can go south fast. From keeping your engine cool to ensuring your brakes respond in a split second, fluids play a critical role in your vehicle’s performance and safety. The good news? You don’t have to be a mechanic to keep tabs on them. With a few simple checks, you can catch issues early and keep your car running smoothly, mile after mile.

Why Fluid Checks Matter

Many vehicle fluids need attention more frequently than the typical 5,000- to 10,000-mile service intervals. Ignoring fluid levels can lead to poor performance, unexpected breakdowns, or even long-term engine damage.

Whether you’re prepping for a road trip or just want to protect your investment, regular fluid checks are a smart habit to adopt.

General Tips for Checking Fluids

Park on a level surface before checking any fluids.

- Never overfill—a little too much can be just as harmful as too little.

- Clean around caps and reservoirs before opening to avoid introducing dirt or debris.

- Always use the type of fluid recommended by your vehicle’s manufacturer (your owner’s manual will have the specs).

- If you find yourself topping off fluids frequently, it could be a sign of a leak or other issue—have it checked by a professional.

- Your owner’s manual is a good first step for knowing where the components are, and what to check.

Engine Oil

What it does: Lubricates engine parts, removes debris, and helps regulate heat.

When to check: Monthly. Change it every 3,000 to 5,000 miles, or according to your car’s recommendations.

How to check:

- Turn off the engine and let it cool.

- Open the hood and locate the oil dipstick (usually marked with a bright handle).

- Pull it out, wipe it clean, and reinsert it fully.

- Pull it out again and check the level. It should fall between the min and max markers.

- If low, add oil slowly and recheck. Usually, one quart is enough to go from the lower to the upper mark.

Check oil quality too:

Rub a little between your fingers. If it feels gritty, it may be breaking down. Look at the color—clean oil is amber or golden. Dark brown or black oil means it’s time for a change. Milky oil? That could indicate a coolant leak—get it checked ASAP.

Brake Fluid

What it does: Transfers force from your foot on the pedal to the brakes themselves.

When to check: Monthly. Replace every 1–2 years, or sooner if braking feels soft or delayed.

How to check:

- Locate the brake fluid reservoir, usually near the back of the engine bay.

- The fluid should be between the min and max lines.

- If it’s low, add the correct brake fluid for your vehicle.

- The fluid should be clear or light yellow. If it’s dark or cloudy, it needs to be replaced.

Note: Brake fluid absorbs moisture over time, which can lead to spongy brakes. Never ignore braking issues and know when you need new brakes.

Transmission Fluid (Automatic)

What it does: Lubricates transmission components and enables smooth gear shifts.

When to check: Monthly. Replace every 30,000 to 60,000 miles, or sooner if shifting feels rough.

How to check:

- Make sure the engine is running and warmed up.

- Engage the parking brake.

- Remove the transmission dipstick (if equipped), wipe it clean, then reinsert and remove it again to check the level.

- Fluid should be red, amber, or pink. If it’s brown, cloudy, smells burnt, or feels gritty, it’s time to change it.

- If low, add the appropriate fluid. Be cautious not to overfill.

Tip: Some newer cars have sealed transmissions. If you can’t find a dipstick, checking the fluid may require a mechanic.

Coolant (Antifreeze)

What it does: Regulates your engine’s temperature to prevent overheating and freezing.

When to check: At least twice a year. Full flush every 2–3 years (or longer, depending on the coolant type).

How to check:

- Only check when the engine is completely cool.

- Locate the coolant reservoir—usually a clear plastic tank with markings.

- Fluid should be between the min and max lines.

- If low, add a 50/50 mix of coolant and water unless your car specifies otherwise.

Warning: Be aware of the location of your radiator. Never open the radiator cap when the engine is hot—it can release scalding steam.

Power Steering Fluid

What it does: Makes steering smooth and responsive.

When to check: Monthly. Replace every 50,000 miles (varies by vehicle).

How to check:

- Turn off the engine.

- Locate the power steering fluid reservoir.

- Check that fluid is at the proper level (some caps have dipsticks).

- Some reservoirs have hot and cold markings—check according to your engine’s temperature.

Watch out for: Difficulty steering or a whining noise when turning could mean low fluid or a leak.

Windshield Washer Fluid

What it does: Keeps your windshield clean and ensures visibility.

When to check: Monthly—or more often in messy weather.

How to check:

- Open the cap to the washer fluid reservoir (usually marked with a windshield icon).

- If the level is low, top it off.

- In warm weather, use a bug-removing fluid. In winter, use a solution with antifreeze properties to prevent freezing.

When to Visit a Professional

While regular fluid checks can prevent many issues, some problems need a pro. Schedule a visit to your mechanic if you notice:

- Leaking fluids under your car—these often appear as puddles or drips.

- Dashboard warning lights—especially related to oil pressure, brakes, or coolant.

- Unusual noises—squealing, grinding, or whining sounds could point to fluid problems.

- Smoke from under the hood—could be due to leaking oil or overheating coolant.

And don’t forget, keeping your fluids in check is just one part of car maintenance. Protect your vehicle with the right insurance coverage to safeguard against the unexpected. Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Ever dreamed of snapping a selfie in front of Dunder Mifflin in Scranton or standing where Walter White once stood in Albuquerque? With a little imagination (and a full tank of gas), a road trip inspired by your favorite TV show can feel like stepping straight into the screen. It’s more than sightseeing — it’s a journey that connects you to the stories, characters, and places that have captured your heart. Suddenly, you’re not just a fan… you’re part of the world.

So fuel up, check out our long-distance driving tips, and get ready for a memorable ride. Here are some ideas to get you started.

Breaking Bad

Albuquerque, New Mexico

Walk in the footsteps of Walter White with a trip to the heart of the Southwest. From the famous car wash to Jesse’s house and more, Albuquerque is filled with filming locations that bring Breaking Bad to life. While Walter’s house has an iron privacy fence now (from too many enthusiastic fans throwing pizzas), there are places you can visit. Drive by the Crossroads Motel, aka The Crystal Palace, or Tuco’s headquarters (now Java Joe’s). Grab a burger or burrito at Los Pollos Hermanos (actually Twisters on Isleta Blvd.) which features memorabilia from the show. Maybe pick up some blue rock candy as a souvenir from the Candy Lady in Old Town Albuquerque.

Gilmore Girls

Litchfield County, Connecticut

A drive through Litchfield County reveals quaint downtowns, cozy diners, and scenery that feels straight out of the show. Start in Washington Depot, the town that inspired Stars Hollow. Sip coffee in a café like Marty’s Cafe that might just remind you of Luke’s. For a Doose’s Market experience, stop at the Washington Food Market. Head to the Mayflower Inn & Spa which was inspiration for the Dragonfly Inn. Schedule a tour at Yale University and imagine Rory’s student life. For the iconic gazebo photo op, don’t miss a trip to New Milford.

Grey’s Anatomy

Seattle, Washington

Even if most of Grey’s Anatomy was filmed in Los Angeles, the show’s soul belongs to Seattle. The real-life Seattle Grace Hospital is actually the KOMO Plaza building, and fans will recognize the famous Seattle skyline and the Space Needle. Ride a ferry across Puget Sound for your own “Meredith and Derek” moment. Stop by the intern house in Queen Anne Hill. (It’s a private residence so enjoy it from a respectful distance.) While you’re there, explore the cool and quirky shops and cafes in the area.

The Marvelous Mrs. Maisel

New York City, New York

Step into the 1950s and ’60s with a tour of the New York City landmarks featured in The Marvelous Mrs. Maisel. From Greenwich Village to the B. Altman department store on Fifth Avenue, fans can stroll through Midge’s world while soaking up iconic city sights, vintage charm, and world-class bagels. Visit the Gaslight Café (actually The Up & Up), where Midge first took the stage. Grab a bite at La Bonbonniere—standing in for The City Spoon in the show—where she dined after her post-jail appearances (just remember, it’s cash only!). See the Strathmore on Riverside Drive, which served as the exterior for Midge’s apartment building, and swing by Columbia University, where her father Abe taught.

The Office

Scranton, Pennsylvania

Make your way to Scranton for a dose of workplace comedy nostalgia. You’ll find the “Welcome to Scranton” sign from the opening credits at the Steamtown Mall. Grab lunch at Poor Richard’s Pub, a real bar frequented by the Dunder Mifflin crew. Bonus points if you wear a “World’s Best Boss” hat. Or try the “good” pizza at Alfredo’s Pizza Café. Don’t miss the mural, The Office: The Story of Us, in downtown Scranton, and the World’s Largest Dundie Award outside Scranton City Hall. While you won’t find the Dunder Mifflin office, you can visit the Pennsylvania Paper & Supply company tower featured in the opening credits.

Stranger Things

Hawkins, Georgia

Head to the Peach State for a glimpse into Hawkins—aka various Georgia filming locations. The kids’ houses were located on Piney Wood Lane in East Point. Jackson, Georgia stood in for downtown Hawkins, and Lucy Lu’s Coffee Café has a special Stranger Things menu. The Butts County Probate Court was the exterior for Hawkins Public Library. You can find the creepy Hawkins Lab at Emory University’s Briarcliff Campus. Fans of the Upside Down will enjoy the mix of small-town Americana and eerie science fiction vibes.

Yellowstone

Montana

For fans of the Dutton family saga, the wide-open landscapes of Montana are calling. Many scenes from Yellowstone are filmed at the real Chief Joseph Ranch in Darby, Montana, which doubles as the Dutton Ranch. Visit Ruby’s Café in Missoula, the location of a memorable shootout. Take a scenic drive through the Bitterroot Valley. Head to Hamilton to tour the Daly Mansion, which was the governor’s residence. Drive the roads – Meridien and Bear Creek – where Kayce’s car chase was filmed. This is a road trip rich with ranch country, mountain views, and that rugged Western spirit.

These are just a few ideas to spark your imagination—there’s a whole world of TV-inspired road trips waiting to be explored. Whether you’re chasing nostalgia, adventure, or just a great selfie spot, the open road is full of possibilities. Have a favorite show or road trip destination of your own? We’d love to hear it!

Ready to hit the road? See our blogs on childproofing your car and road trip preparation.

Finally, make sure your car is covered—so you can enjoy the ride with peace of mind. Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You take pride in your car’s appearance—shiny, clean, and polished to perfection. But even the most careful car owner can fall victim to everyday threats that silently sabotage that showroom sparkle. From spilled coffee to sunbaked bird droppings, the dangers are everywhere. Here’s what to watch out for—and how to fight back.

1. Parking Under Trees

Shady spots might seem like a great way to beat the heat, but trees come with risks. Sticky sap, falling branches and twigs, and even acorns can wreak havoc on your paint. Sap is especially stubborn—it bonds with the surface and can damage the finish over time. Use a bug and tar remover from your local auto store to gently lift it off.

2. Bird Droppings

Think of bird droppings as acid bombs for your paint job. They harden in the sun and can etch into your car’s finish if left too long. Wipe them off with a wet microfiber cloth using a gentle lifting motion (don’t scrub!). You can let the cleaner sit for a few minutes if needed to soften hardened spots.

3. Bug Splatter

Bugs on the windshield are just an annoyance. But bugs on your paint? That’s a problem. Many insects contain acidic compounds that can damage your finish. Clean them off ASAP with a dedicated bug remover or mild soap and water.

4. Fuel Spills

Fuel stains are more than ugly—they’re damaging. Gasoline can eat away at your paint and leave behind stubborn marks. Avoid topping off the tank to help prevent the chance of spills. If there’s a spill, clean it up immediately. Pro tip: Older brake fluid is also a known paint-stripper, so be extra careful when topping off your fluids.

5. Road Salt

Winter driving means road salt—and that means potential rust. Salt can corrode your car’s underbody and eat away at the paint if left unwashed. Rinse your car regularly in the winter and consider a protective wax coat before the first snowfall. Coastal drivers, take note: salty ocean air can do the same.

6. Writing in the Dust

We get it—drawing “Wash Me” on a dusty car is tempting. But those dust particles? They’re basically sandpaper. Dragging them across the surface can create micro-scratches. Dust mixed with rainwater can also become acidic, further damaging your finish. When you see dust, that’s a great time to run your vehicle through a car wash.

7. Dirty Sponges & Harsh Car Washes

Washing your car with a dirty sponge just grinds more grime into the paint. Stick to clean microfiber cloths, and avoid old-style brush car washes, which can leave swirl marks. Soft-cloth or touchless car washes are safer choices.

8. Coffee and Soda Spills

Placing your cup on the roof while fumbling for keys? We’ve all done it. But if you spill sugary or acidic drinks, they can stain your paint fast. Wipe off any spills immediately, especially soda and coffee.

9. Silly String & Shaving Cream Pranks

They might seem harmless, but Silly String contains resins and dyes that can bond to your paint, and shaving cream can leave behind lasting stains. If your car becomes the victim of a prank, rinse and wash it thoroughly as soon as possible.

10. Sprinkler Water Spots

Those white spots you see after a sprinkler hits your car? That’s mineral buildup from hard water, and over time, it can wear away your clear coat. Always dry your car with a microfiber towel—don’t let it drip dry.

Protect Your Paint Like a Pro

You can take steps year-round to protect your paint, and help it last longer.

- Park in a garage or covered area whenever possible.

- Wash your car regularly, especially after road trips or storms.

- Dry it completely with a microfiber towel to avoid water spots.

- Remove bird droppings, sap, and bugs as soon as you spot them.

- Wax your car every 3 to 6 months to maintain a protective barrier.

Your car is one of your biggest investments. Protect it with the right insurance for added peace of mind.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

The freedom of summer is calling, and for many teens, that means hitting the road—often for the first time without a parent in the passenger seat. With new jobs, beach days, late-night hangouts, and spontaneous road trips on the agenda, it’s easy to forget that driving comes with serious responsibility. For parents, this season is a crucial time to set clear expectations behind the wheel. From curfews to passengers to phone use, establishing ground rules now can help your teen build smart habits that last far beyond the summer.

Follow intermediate licensing laws in your state.

Most states have graduated driver licensing (GDL) programs designed to help teens gain experience behind the wheel while minimizing risks. These often include rules like curfews, limits on passengers, and restrictions on highway driving. Start by familiarizing yourself with your state’s laws at www.ghsa.org. Then, build on those requirements with your own family rules. For instance, you might allow only daylight driving for the first month, then gradually expand driving privileges as your teen demonstrates responsibility.

Establish a nighttime curfew.

Driving at night is inherently more dangerous due to decreased visibility and increased likelihood of encountering impaired drivers. Teens, who are still developing experience and judgment, are especially vulnerable. Even if your state allows nighttime driving, consider setting a curfew that keeps your teen off the road during high-risk hours—often between 9 p.m. and 6 a.m. You might also require that they log a certain number of supervised nighttime hours with you before being allowed to drive alone after dark.

Ban cell phone use while driving.

Distracted driving is a leading cause of accidents, and teens are especially susceptible. While some states ban any cell phone use for drivers under 18, it’s smart to create a zero-tolerance rule at home regardless of local laws. That means no texting, no scrolling, and ideally, no hands-free calls unless absolutely necessary. Consider installing monitoring apps that block texts and calls while driving, and most importantly, model good behavior yourself—your teen is watching.

Talk about speeding—and how to avoid it.

Speeding contributes to nearly a third of all fatal teen crashes. Stress the importance of following posted speed limits, adjusting for weather conditions, and maintaining safe following distances. Teach your teen the three-second rule for following other vehicles, and how to give extra space to large trucks. Encourage them to build in extra time when leaving for work or social plans so they’re never tempted to rush.

Enforce seat belt use—every ride, every time.

Seat belts save lives, plain and simple. Make it a non-negotiable rule: the car doesn’t move until everyone is buckled up. Remind your teen that they are responsible for their passengers’ safety, too. Unbelted passengers can become deadly projectiles in a crash—even in the back seat.

Address impaired driving before it happens.

Teens may face peer pressure to drink or ride with someone who’s been drinking. It’s essential to talk openly about these situations and offer a safe exit plan. Let your teen know they can always call you for a ride—no questions asked—if they’re ever in an unsafe situation. Emphasize that driving under the influence of any substance, including marijuana or even some medications, is never acceptable.

Being a safe driver also means being prepared. Make sure your teen knows how to check the gas gauge and fill up when needed—ideally before it dips below a quarter tank. Show them how to recognize warning lights, check tire pressure, and know what to do in case of a breakdown. A quick review of the vehicle’s manual can go a long way in empowering your teen behind the wheel.

Know your teen’s driving plans.

As your teen begins driving independently, stay in the loop. Ask them to let you know where they’re going, who they’ll be with, and when they plan to return. If plans change, they should update you before getting behind the wheel again. Keeping control of the car keys is one way to ensure that you stay informed.

Put it in writing.

Consider drafting a parent-teen driving agreement that outlines the rules and consequences clearly. This written commitment can serve as a helpful reminder and a great conversation starter. It also opens the door for regular check-ins to reassess the rules as your teen gains experience. Be sure to revisit the agreement periodically, especially if any violations or concerns arise.

Don’t forget the insurance.

Before your teen starts driving, make sure they are properly insured. In some cases, good student discounts and safe driving programs can help lower costs. Most importantly, you want to be sure your teen is covered in the event of an accident.

Summer driving can be a rite of passage for teens—and a nerve-wracking time for parents. But with the right rules and a foundation of open communication, you can help your teen navigate this new freedom safely. Remember, driving is a privilege that comes with responsibility. By setting clear expectations and modeling safe behavior yourself, you’re laying the groundwork for a lifetime of smart driving choices.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Nothing throws a wrench in your day like the sudden thump-thump of a flat tire. But instead of panicking or waiting for roadside assistance, imagine confidently pulling over, grabbing your tools, and getting back on the road in no time. With a little know-how and a few easy steps, you can change a flat tire like a pro—and we’re here to show you how.

Step 1: Pull Over Somewhere Safe

At the first sign of a flat, slow down and carefully pull over to a safe location. Aim for a flat, firm surface away from traffic—never on grass, dirt, blind spots, or curves. If it’s nighttime, look for a well-lit area to work more safely. Turn off your engine, engage the parking brake, and switch on your hazard lights.

Step 2: Gather Your Tools and Supplies

You’ll need a few essentials to get the job done:

You might also find it helpful to have:

- Wheel wedges

- Tire pressure gauge

- Flathead screwdriver

- Portable tire inflator

- Flashlight (for nighttime)

- Gloves (to protect your hands)

Most of these tools can be found in a compartment under the rear cargo area—check your owner’s manual for specifics. It’s a good idea to keep these items, along with jumper cables and other emergency supplies, in your trunk or car storage.

Important: Some newer vehicles don’t come with spare tires. Instead, they may have run-flat tires or a spray sealant and inflator kit. In these cases, you will not be changing a tire. With run-flats, the tire’s reinforced sidewalls will allow you to drive for a short distance at a lower speed to a shop where you can get your tire replaced. If you have a spray sealant and inflator kit, follow those directions for the temporary tire repair, and again, drive to a place for a replacement.

Step 3: Loosen the Lug Nuts

Use the lug wrench to loosen the lug nuts (turn counterclockwise), but don’t remove them yet. Do this while the car is still firmly on the ground for better leverage. If they’re on tight, you may need to use your body weight. If your lug nuts are hidden behind hubcaps, use a flathead screwdriver to pop off or unscrew the hubcaps. Always check your manual if you’re unsure.

Note: If you have wheel locks, you will need to use your wheel lock “key” (adaptor) to loosen the specialized lug nuts.

Step 4: Position the Jack

Find your car’s designated jack points—typically near the wheels under the frame—and place the jack on the metal portion of the car. Jacking up in the wrong spot can damage your vehicle or cause it to become unstable. If you have them, this is the time to put wedges or chock blocks behind the wheels for added support. If you’re lifting the front of the car, put the block behind the back tire. For lifting the back of the car, put the block in front of the front tire. Choose the opposite corner of where you’re going to lift.

Once the jack is in place, slowly raise the car until the flat tire is about an inch or two off the ground. Never crawl under the vehicle while it’s supported only by a jack. (Need a refresher on jacking up a car? Check out our blog on how to use a jack!)

Step 5: Remove the Lug Nuts and the Flat Tire

Now that the car is elevated, remove the loosened lug nuts completely. Keep them safe—an upturned hubcap works perfectly as a container. Give the flat tire a firm pull to remove it from the wheel hub.

Step 6: Put on the Spare Tire

Line up the spare tire with the wheel studs. Make sure the valve stem (where you add air) is facing outward toward you. Place the lug nuts back on, tightening them by hand to hold the spare in place.

Step 7: Lower the Vehicle and Tighten the Lug Nuts

Carefully lower the vehicle back to the ground and remove the jack. Then, use the lug wrench to firmly tighten the lug nuts in a crisscross (star) pattern to ensure even pressure. Consult your manual if you’re unsure about the pattern.

Step 8: Check Your Tire Pressure

Use your tire gauge to check the spare’s pressure—and while you’re at it, check the other tires too. If needed, stop by a gas station for a quick top-off or use a portable air compressor if you have one handy. If you have nitrogen-filled tires, you’ll need to head to a shop that offers nitrogen.

Step 9: Pack Up Your Tools

Make sure you return all your tools and supplies to their proper storage locations, so you’ll be ready next time.

Step 10: Remember: The Spare Is Temporary

If you’re using a smaller “donut” spare, drive carefully. Stay under 50 mph and get your tire professionally replaced as soon as possible. Even if you have a full-sized spare, it’s still smart to replace it quickly and reset your vehicle’s emergency kit. It’s also a good idea to periodically check your spare’s condition and pressure. (You’ll find the recommended PSI in your owner’s manual).

How to Help Avoid a Flat Tire

While you can’t always prevent a flat, you can minimize your risk by following these tips:

- Inspect Your Tires Regularly: Check for signs of wear, punctures, and bulges.

- Maintain Correct Tire Pressure: Follow the recommended PSI found in your owner’s manual or inside the driver’s side door.

- Rotate Your Tires: Every 5,000 to 8,000 miles helps ensure even wear.

- Avoid Road Hazards: Steer clear of potholes, debris, and rough surfaces when possible.

- Don’t Overload Your Vehicle: Excess weight strains your tires and increases the risk of blowouts.

Finally, protect yourself and your vehicle with the right insurance for added peace of mind. Safe travels.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.