Although it is recommended to review your home and auto insurance policies yearly, 60% of all Americans are underinsured and/or don’t understand their policies. Do you know what’s really covered with your insurance policy?

If you don’t or you have any doubts, now is a great time to get an annual review of your auto and home/renters insurance policies. You’ll sleep better at night knowing you are protected against expected surprises if you have a claim. You may also find you are eligible for additional savings and discounts!

Here are seven examples of why you should contact your insurance advisor to review your policy:

- You got married. Newlyweds often pay less for insurance than when they were single. You can also find discounts by combining your autos with one insurance company. It also means all those expensive wedding gifts you received might need extra protection.

- You got divorced. You probably are no longer sharing a vehicle and moved into a different residence. You’ll need to inform your insurance company to set up separate auto and home or renters insurance policies.

- Your teen got a driver’s permit or license. You need to let your insurance company know if they are driving your vehicles, or if you bought them one. Make sure that you take advantage of good student discounts and additional multi-vehicle savings!

- You bought or inherited valuables such as antiques, fine art, jewelry or other collectibles. Your standard homeowners or renters insurance policy provides limited coverage of high dollar items. This is a good time to purchase scheduled personal property endorsements to cover your new valuable possessions for a higher amount.

- You’ve added on to your home or have remodeled. Improvements to your house mean there is more to protect. Contacting your insurance company is a good way to make sure that you have enough coverage. This also applies for a new gazebo, shed or pool, or hot tub.

- You’ve moved to a flood or earthquake prone area. Neither earthquake nor flood insurance is included with most homeowners or renters policies. You need to purchase separate flood or earthquake insurance. Keep in mind that flood insurance has a 30-day waiting period before it becomes effective.

- You’ve retired. This often means you are driving less, which could significantly reduce your insurance costs. Drivers over 55 also often get discounts from their insurance companies and you can further reduce your premiums by completing a driver safety course.

Knowing more about your insurance could save you money on your premiums and heartache in the event of a break-in or natural disaster.

If it is time for your auto or home insurance coverage review contact one of our customer care advisors today at 1.800.800.9410. A few minutes of your time will provide the appropriate protection, and we may even find you some extra savings!

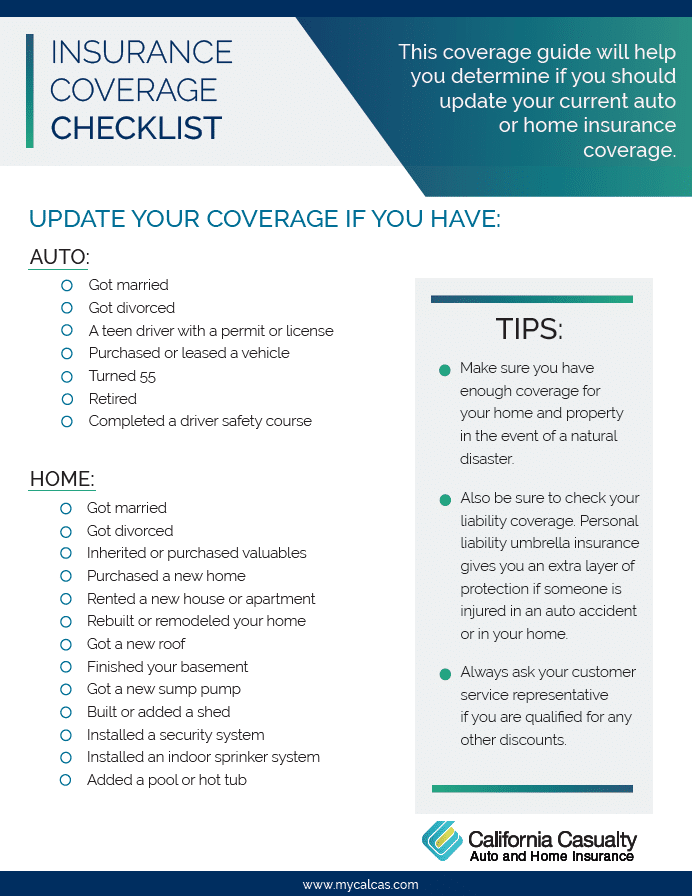

If you don’t know where to start to determine if it’s time for your policy review, download our free Insurance Coverage Checklist. Just click the image below for your free download!

- Graduation – When to Remove Your Child from Your Auto Policy - May 18, 2023

- How to Prevent Catalytic Converter Theft - May 17, 2023

- How Much Does Home Insurance Cost? - May 17, 2023