by California Casualty | Homeowners Insurance Info |

By: Nick Magoteaux

As a fire prevention officer of a fire department, I take fire prevention seriously. At the fire department, we can only inspect commercial buildings for fire codes, but you can do your own inspection to make sure your household is safe. Here are a few tips to make your house just a bit safer for yourself and firefighters.

- Do not overload electrical outlets. In commercial buildings, multi plugs are limited to ones that are only certified by Underwriters Laboratory. Multiplugs and certain surge protectors can overheat causing fires.

- If you use an extension cord, unplug it after every use. Same as the multiplugs, extension cords can overheat over time causing a fire.

- Make sure your smoke detectors have fresh batteries. Smoke detectors save lives – period! Make sure your smoke detectors are in good working order and have fresh batteries. If a fire occurs, they will save your life. The more smoke detectors you have, the safer you are, but try not to put one in or around the kitchen (in case you cook, like I do).

- Make sure your electrical panel is clear of obstructions. Firefighters have limited vision in the smoke of a house fire. We must be able to locate and shut off the power to the house to ensure our safety. Keeping the area around the electrical panel clear and clean is an absolute help. A rule in businesses is to keep three feet of clearance around the electrical panel.

- In the wintertime, if you use a space heater, make sure to give them space. A rule of thumb for space heaters is put approximately five feet of surrounding clearance. If you have an older model, you may want to consider replacing it. Older space heaters do not have the mechanism to turn off if knocked over. Also, before leaving that the room with the space heater for extended periods of time, unplug the space heater. This will prevent a fire.

These may seem like small things you can do, but they will prevent a fire or help a firefighter battle your house fire (hopefully won’t get to that point). It’s always better to err on the side of caution, then having to deal with a house fire.

Nick Magoteaux has been in public safety for over 15 years. Nick has experience in law enforcement, dispatching, firefighting, and emergency medical service. Nick currently works for four different fire departments in Southwest Ohio, including the busiest fire department per capita in the state. Nick is also the founder and co-executive director of Brothers Helping Brothers, a fire service 501c3 non-profit that specializes in equipment grants to small and rural fire department in the US. Contact Nick at [email protected].

Nick Magoteaux has been in public safety for over 15 years. Nick has experience in law enforcement, dispatching, firefighting, and emergency medical service. Nick currently works for four different fire departments in Southwest Ohio, including the busiest fire department per capita in the state. Nick is also the founder and co-executive director of Brothers Helping Brothers, a fire service 501c3 non-profit that specializes in equipment grants to small and rural fire department in the US. Contact Nick at [email protected].

by California Casualty | Homeowners Insurance Info, Safety |

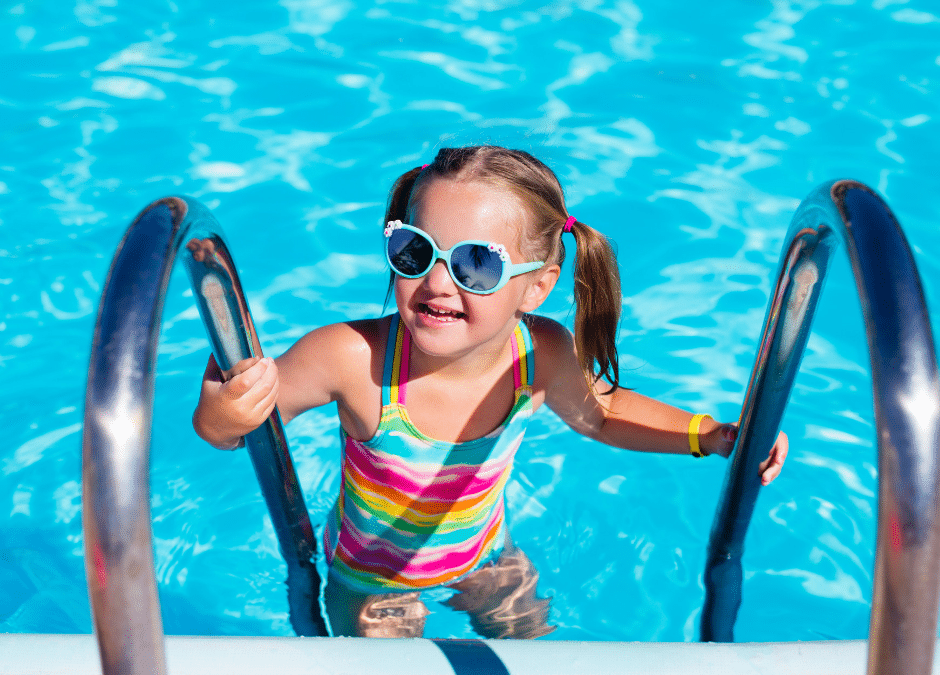

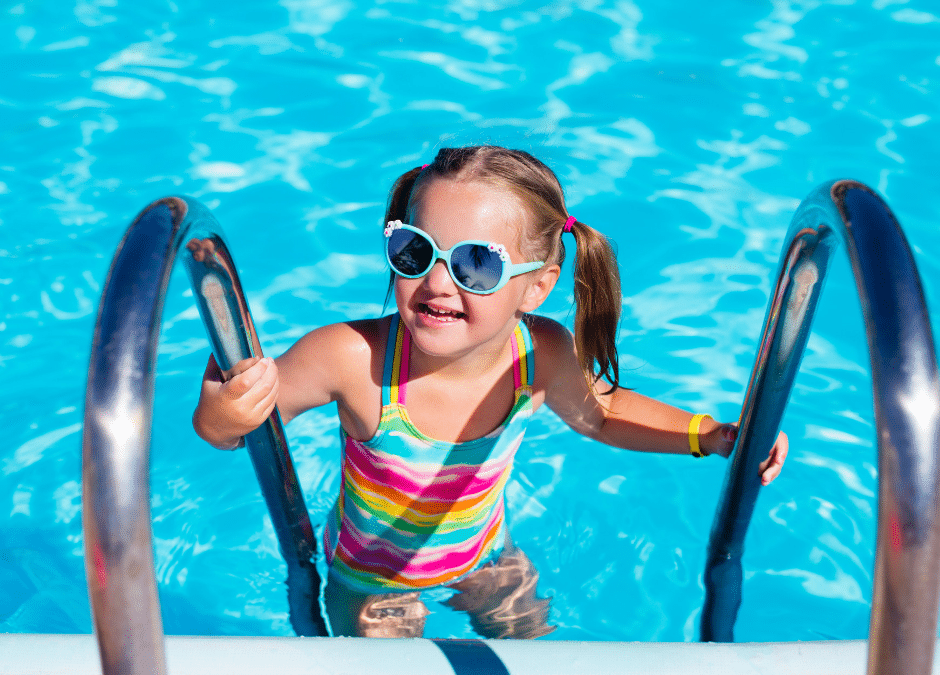

It’s time to brush off your barbecue grills, stock up on popsicles, and get a new swimsuit because summer is practically here! After a winter with too much snow and a spring with too much rain, we are more than ready for summer. And if your neighborhood is anything like ours, then the arrival of summer means one thing: water safety tips

POOL SEASON!

In the excitement of summer, it’s tempting to just throw on a suit and jump on in the water. But wait…for most of us, it’s been about a year since we dipped our toes in the water. Now that may not seem like a long period of time, but for young children, it could mean life or death.

Pool Safely, a national public education campaign that works to reduce child drowning, states that drowning is the leading cause of unintentional death in children ages 1-4. However, these deaths can easily be prevented by taking action and learning how to keep your child safe when enjoying the water. So before you and your family cannonball in make sure you review these

9 simple Water Safety Tips:

“Drowning is the leading cause of unintentional death in children ages 1-4.”

1. Maintain constant supervision whenever children are in or near water.

Never leave kids unattended, avoid all distractions, and if a child is missing check the pool first.

2. Teach your child how to swim or give them a life jacket.

Floaties or other inflatables are not life jackets and should never be substituted for adult supervision.

3. Teach children to stay away from drains, pipes, and other openings to avoid entrapment.

Make sure all drains and pipes are covered before letting your child get into the water.

4. Never let your child swim alone.

Always keep an adult present, do not trust your child’s life to another child.

5. Teach your kids the “Rules of the Pool”.

Set ground rules for being in the pool, like only getting in at certain times and no pushing or diving.

6. Keep your pool clean and clear with the proper chemicals.

You will be able to clearly see what is happening in your pool, and minimize the risks of earaches, rashes, and diseases.

7. Create barriers for your pool that will reduce the risk of a slip or fall.

Isolate your pool from your home with a fence or locked gate and keep toys away from the pool.

8. Educate yourself on what real drowning looks like and how to spot it.

Real drowning can be quiet and easy to miss.

9. Learn CPR and know when to call 9-1-1.

Have a plan in place with your children on what to do during a water emergency.

Summer is a time of relaxation and you enjoy it. But remember, it only takes one second for your child to go under the water. Take action by educating yourself and your children to make sure everyone is prepared with the right skills and equipment before hitting the pool, to ensure a fun and safe summer break! Click here to learn more about Pool Safely’s tools and educational materials for water safety.

And don’t forget! There are insurance implications for those with pools. Accidents happen so frequently, having one is considered an “attractive nuisance,” increasing liability risk. Because of the increased danger, the Insurance Information Institute says pool owners may want to increase their liability coverage to at least $300,000 or $500,000.

Don’t let it break your bank, if you have a pool make sure you have sufficient liability coverage from your homeowner’s insurance. Call a California Casualty advisor today for a policy review, 1.800.800.9410 or visit www.calcas.com.

Cannonball away!

More information for this article can be found at:

https://bit.ly/2WdfFSx

https://bit.ly/2XbA0nS

https://bit.ly/2Kcnu3K

by California Casualty | Homeowners Insurance Info |

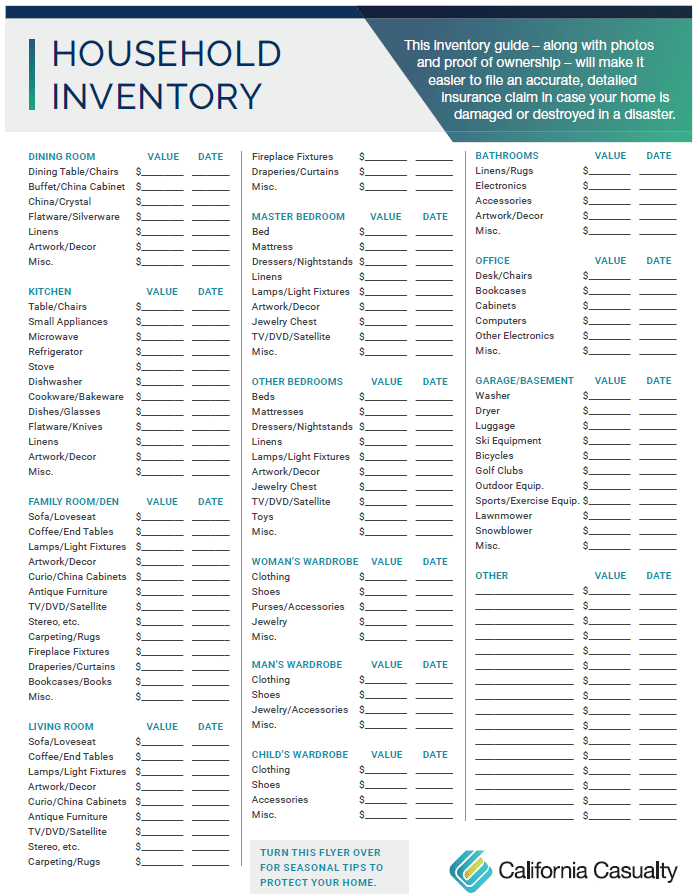

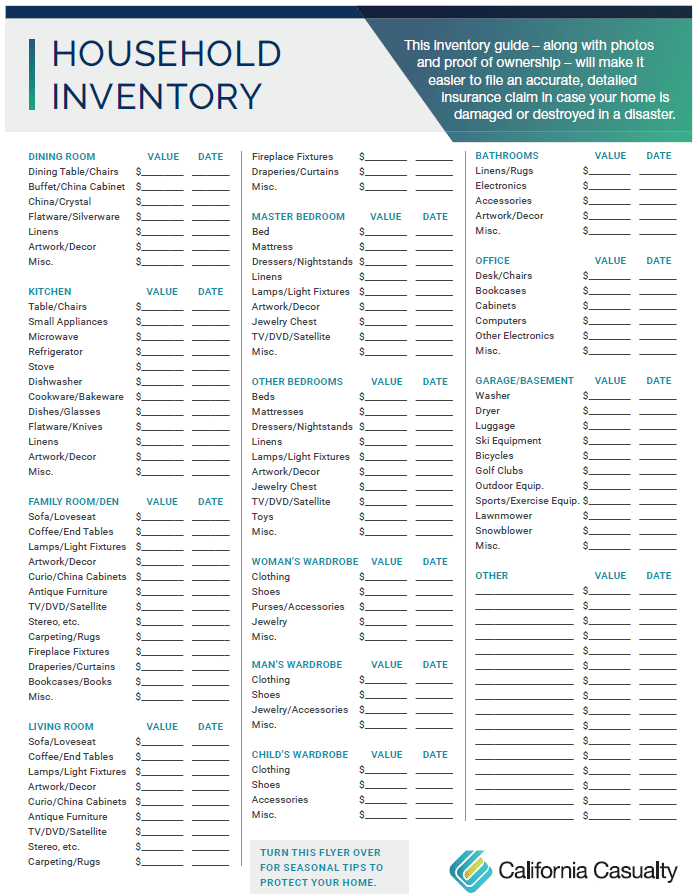

Here’s an unsettling statistic – about half of US households still haven’t completed a home inventory. Of those who have done one, 40 percent haven’t updated it in many years. It’s a resolution that we urge you to make.

Why? You’ve worked hard to make your house a home. Now it’s time to create a record of everything that you own. Trying to tally what needs to be replaced is not something you want to do in the event of a claim.

Home inventory is so important. It provides a list of your things in case there is a fire, destructive storm or someone breaks in and steals your valuable belongings. Without an inventory, many people have a difficult time pinpointing or recalling everything that might have been destroyed or taken. That could delay your claim or keep you from getting full compensation.

Whether you choose to write everything down or use a video camera (like your phone), now is a great time to get started. Just go room by room and document:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items and appliances

- Furniture

- Carpeting

- Beds and linens

- Clothing

- Sports equipment

- Yard and garden tools

Don’t forget to take pictures of the exterior of your home from all sides (including the landscaping and any decks or porches), and all the stuff in the garage, attic or basement (holiday ornaments, lawn and yard equipment, tools).

Completing your inventory will give you some peace of mind if the worst should happen. We’ve got a handy home inventory guide that you can download here.

by California Casualty | Homeowners Insurance Info, Safety |

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.

By taking the time to educate yourself and following some simple precautions, you’ll be better prepared to protect your family and home from a break-in ever occurring.

Know it: A security system may prevent a burglar from even attempting to break in.

Do it: Have a security system installed and monitored – and display the yard signs and window stickers you are provided.

Know it: Thieves sometimes rely on the cover of night, but most burglaries happen between 10am and 3pm while many people are at work or school.

Do it: Keep bushes and shrubs trimmed back. Consider getting motion activated security. Leave on a TV or radio. A barking dog can serve as a great deterrent to thieves – while you get to enjoy a wagging tail and a wet nose when you arrive home.

Know it: Burglars are often familiar with your neighborhood or daily schedule.

Do it: Varying your routine will make it harder for the bad guys to tell when you’re not home.

Know it: Signs that you’re on vacation or out of town for an extended period can make your home an easy target for burglary.

Do it: Put your mail, newspaper and deliveries on hold. Have a trusted friend or neighbor watch your home. Put indoor lights on timers. Some police departments offer an out of town home watch. If your local authorities provide this service, be sure to sign up several days prior to going out of town. Be vigilant about what you and your family post on social media.

Know it: 34% of burglars enter through the front door. Another 30% take advantage of unlocked windows or other unlocked doors.

Do it: LOCK YOUR DOORS AND WINDOWS! Keep your garage doors closed, even when home.

Know it: The top three things a burglar is looking for are cash, prescription drugs and jewelry but don’t doubt that these criminal opportunists will take anything they can get their hands on. Unfortunately, this often includes your identity.

Do it: Don’t leave valuables, cash or items that can be used for ID theft in plain sight or hidden in obvious places. Keep an up-to-date home inventory with a record of serial numbers from electronics to aid in filing police reports and insurance claims. Be sure to have an identity theft protection and recovery service if burglars get access to your personal or banking information.

We can’t stop all criminals, but California Casualty is here to protect you with quality auto and home / renters insurance with exclusive benefits not available to the general public. Every policy also comes with free ID theft protection.

Sources for this article:

https://www.iii.org/press-release/vacation-bound-use-these-five-prevention-tips-to-protect-your-home-against-burglars-while-youre-away-070312

https://www.safewise.com/blog/8-surprising-home-burglary-statistics/

by California Casualty | Homeowners Insurance Info |

The summer storm season is here. There has been record flooding, a rash of tornadoes, and an increase of insurance claims due to hail in many areas of the country. The National Oceanic Atmospheric Administration (NOAA) estimates that hail causes $1 billion dollars in damage to property and crops every year, and the combination of wind, hail, and flood account for over $16 billion in insured damage. Severe weather losses have risen dramatically in the past few years due to increased repair costs and the severity of the storms.

Are you prepared? A major storm is no time to find your possessions are below the water line or you have nothing to cover your windows if they should be blown or broken out. Here are things you can do now:

- Survey your property for flood potential, levees, etc.

- Make sure trees on your property are healthy and properly trimmed

- Check and clean gutters and downspouts

- Have your roof inspected to make sure it is still waterproof and will shed excess rain

- Install a sump pump in basements ( many experts recommend a second battery-powered sump pump in case of excess water or if there’s a power outage)

- Install shutters to protect your home from high winds and hail

- If you don’t have shutters, make sure you have boards 5/8 exterior grade or marine plywood to cover windows and doors

- Make sure you have flood and sewage backup coverage

- If possible, park your vehicle in a covered spot or in a garage

- Purchase a hail-resistant cover for your vehicle

- Complete a home inventory

- Prepare an evacuation kit

- Know safe evacuation routes and have a family communication plan if you get separated

Before the next storm hits, it’s important to make sure you have the proper insurance and understand what is and is not covered. Here are things you need to know:

- Most homeowners insurance does not cover the flooding from high water. Separate flood insurance needs to be purchased.

- Most homeowners insurance covers hail, wind and lightning damage to your property, often with a deductible that you pay first.

- You must have comprehensive coverage on your auto insurance policy to cover your vehicle from hail, flood, or damage from falling trees or limbs. It also usually comes with a deductible.

Here is what you should do if you suspect your home or car has suffered storm damage:

- Document the time, date and severity of the storm

- Contact your insurance company

- Work only with licensed contractors for repairs and check with the Better Business Bureau to prevent fraud

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

Be sure to download and print your copy of the Household Inventory Checklist by clicking here.

Nick Magoteaux has been in public safety for over 15 years. Nick has experience in law enforcement, dispatching, firefighting, and emergency medical service. Nick currently works for four different fire departments in Southwest Ohio, including the busiest fire department per capita in the state. Nick is also the founder and co-executive director of Brothers Helping Brothers, a fire service 501c3 non-profit that specializes in equipment grants to small and rural fire department in the US. Contact Nick at [email protected].

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.

In the US, home break-ins occur about every 18 seconds. That’s pretty alarming. Not only can a thief steal your belongings, they can rob your peace of mind leaving you and your family feeling violated, scared and even angry.