by California Casualty | Auto Insurance Info, Homeowners Insurance Info |

While there may be some debate about the cause, more and more people are accepting the fact that a changing climate is leading to extremely erratic weather with more intense storms, prolonged drought, and rising temperatures.

This has led to some of the most dramatic disasters in the U.S. Throughout these impressive weather swings, roofs have been damaged, homes flooded, trees toppled and vast acreage blackened. Many property owners are wondering what’s next and what they can do to safeguard their property?

Here are some important steps that you can take to help protect your property and your family from the major effects of climate change.

Storms

Snow and ice storms, hurricanes and spring/summer thunderstorms have become more intense. From record hail, tornado outbreaks, and torrential downpours; our homes and property are taking a beating.

When these storms hit, check and repair:

- Roofs and shingles

- Gutters and downspouts

- Decks and porches for loose, cracked or exposed wood

- Exterior for chipped or peeling paint, cracks, holes or exposed wood or siding

- Attics for evidence of leaks

- Basements or crawl spaces for damp areas and cracks

- Concrete slabs for cracks or shifting soil

- Chimneys for damage or dirty flues

- Trees and bushes for broken or weak trunks and branches, and removing any branches that overhang your home

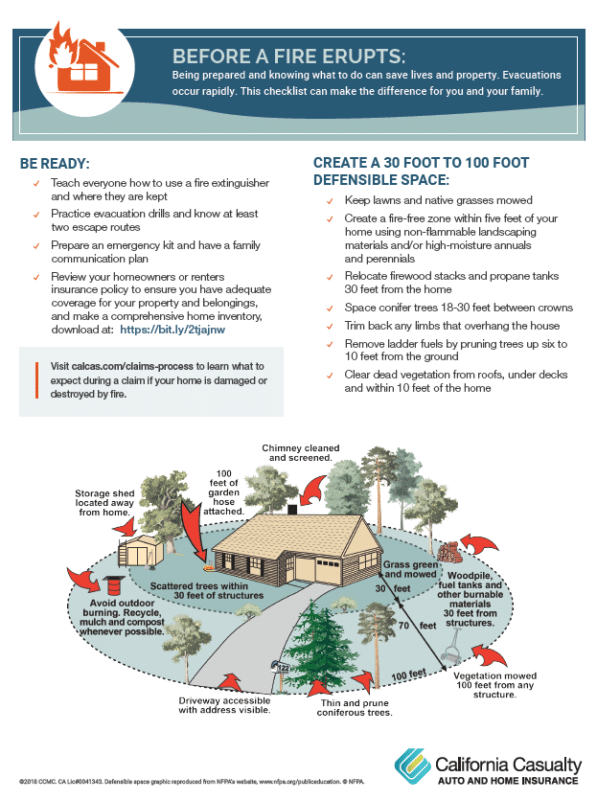

Fire

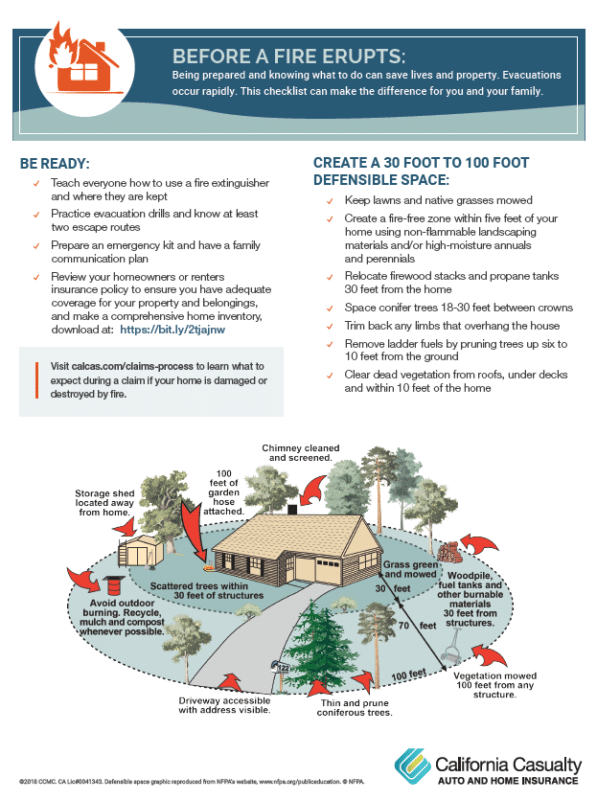

Wildfires in much of the country have burned hotter and consumed more structures and acreage in recent years. Climate change has extended the fire season by an extra two months across the U.S.! In much of the South and West it begins in early spring, ending late fall.

Fire prevention experts recommend that anyone in or near a fire-prone area, especially what is called the Wildland Urban Interface (WUI), needs to take these steps to minimize their fire risk and help responding crews:

- Create at least a 100 foot defensible space area around homes and structures (200 feet or more may be needed on hillside areas)

- Keep combustible wood piles, propane tanks and other flammable materials 30 feet from homes and structures

- Remove weeds and dry shrubs near structures

- Keep laws trimmed and mowed

- Trim tree branches 10 feet up from the ground and remove any that overhang your home or other structures, and keep trees spaced 30 feet apart

- Install a fire resistant roof and deck

- Make sure your street name and address are visibly posted for emergency vehicles

- Clear flammable vegetation 10 feet from roads and five feet from driveways, and cut back overhanging branches on roads and drive ways

Keeping your home well maintained is essential to withstand the vagaries of weather. You can find more wildfire preparation tips here.

Know Your Insurance

In the event of these extreme storms it is also critical that you understand your insurance and know:

- If your homeowners policy includes replacement cost or actual cash value,

- Whether you are covered for new additions, improvements or appliance and other upgrades,

- That a floater or scheduled personal property endorsement is needed to fully cover high value items such as fine art, furs, jewelry, silverware and musical instruments

Keep in mind: flood and earthquake insurance are not included with your home or renters policy. However when you have California Casualty, you can easily add each to your policy though our agency services program. Please contact: 1.877.652.2638 or [email protected] .

Another important coverage you should add to your policy is comprehensive coverage. Without it your vehicle won’t be protected if it is damaged or destroyed by a flood, fire or falling tree limb. To ask a customer service representative about adding comprehensive coverage please contact: 1.800.800.9410 or visit www.calcas.com

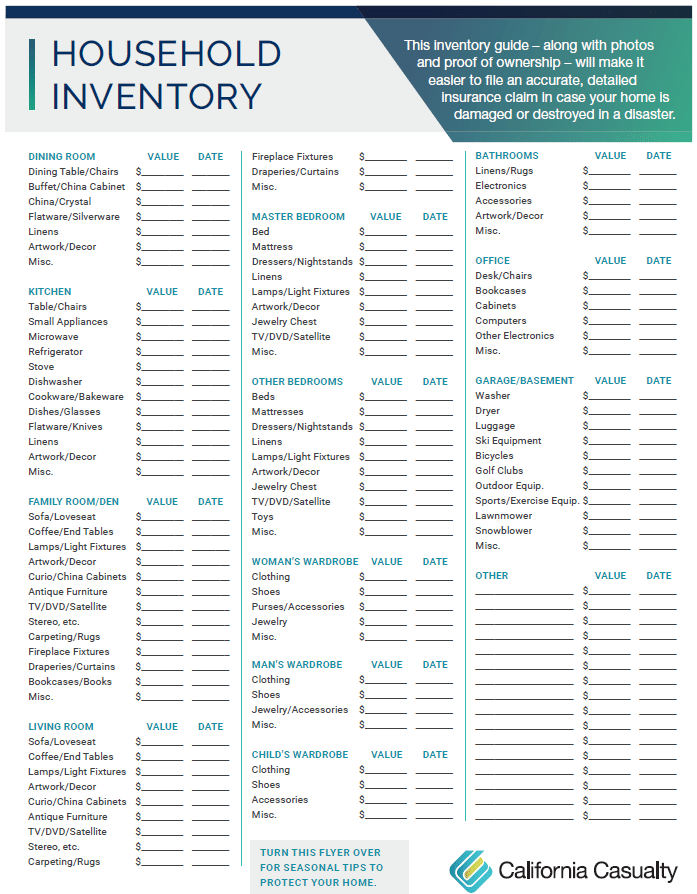

Lastly, make sure your belongings are also completely covered in the event of a storm or fire. If you haven’t completed a home inventory yet, now is the time to do it. Having a list and proof of the things you own will help you with reimbursement if your home or apartment is damaged by a natural disaster. For our free Home Inventory Guide click here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Summertime is in full swing! However, along with summer heat is the threat of summer burglary. Nobody wants to return home to find someone has burglarized their hard-earned possessions.

Unfortunately, the U.S. Department of Justice warns that break-ins heat up during the summer months. Most of those are crimes of opportunity from criminals looking for an easy target like open windows or garage doors.

Here are some tips to prevent a summer burglary:

Make Your Home Less Vulnerable

- Trim back bushes or hedges that block visibility and give a thief areas to hide

- Install outdoor lighting

- Put indoor lights on timers

- Have a security system installed

- Get a dog

- Keep garage doors closed

- Always lock doors and windows

- Keep watch of your neighbors’ homes and ask they do the same for you

- Have a trusted friend, neighbor or relative make trips to your home or park a car in the driveway to make it look lived in while you are away

Don’t Advertise to Criminals

- Stop mail and newspaper deliveries if you are going away

- Arrange for any home deliveries to your neighbors when you are not home

- Don’t leave garbage cans out while you are away

- Never leave notes on doors telling someone you are out and when you will return

- Leave a radio or TV on while you are away

- Conceal valuables and don’t them visible from the outside

- Break down and conceal boxes for expensive items and electronics when putting out the trash (boxes for the new 60” HD TV or the latest computer are like shopping flyers for thieves)

- Don’t advertise on social media that you are going away to grandma’s house or a wonderful vacation (this goes for your children)

Protect Yourself

- Make a complete home inventory of your possessions to assist if you need to file a police report, speed up an insurance claim and help with a tax-loss write off

- Be sure to have an identity theft protection and recovery service if burglars get access to your personal or banking information

- Protect your possessions with homeowners or renters insurance

Not only do you feel violated after someone breaks into your home, but it can be expensive to fix the damage and replace items. That’s why you need homeowners and renters insurance. We can’t stop all criminals, but California Casualty is here to protect you with quality auto and home insurance with exclusive benefits not available to the general public. Every policy also comes with free ID theft protection. Call an adviser today for a policy comparison or review at 1.800.800.9410, or visit www.calcas.com.

For more information visit:

https://bit.ly/2JXf93n

https://bit.ly/2YlWhDe

This article is furnished by California Casualty, providing auto and home insurance to teachers, law enforcement officers, firefighters and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Homeowners Insurance Info, Safety |

Wildfires seem to be burning faster and more intense than ever. The past few years have seen the largest and most destructive conflagrations in US history. Wildfire preparation tips are more important than ever.

Too many people have come back to find melted remnants of prized personal possessions; homes in ashes.

Here are five key wildfire preparation tips for your community or neighborhood:

- Create a home inventory. 60% of homeowners and renters have still not documented the things they own, which can cause post-fire/disaster headaches.

- Know where fire extinguishers are kept and teach everyone how to use them. Make them easily accessible in the event an of emergency.

- Have a family escape plan. Practice how you would exit your home from different rooms in the event of a fire and set a safe meeting point, away from the property, if you were to get separated.

- Prepare an emergency kit with important documents. Include copies of banking information, insurance policies, home mortgage and deeds, etc.

- Review and understand your insurance policy. Whether you are renting or owning, know what it pays and does not pay for. Get extra protection for collectibles and high-dollar possessions with a scheduled personal property endorsement.

While these are great wildfire preparation tips, there are several other things to keep in mind in you are effected :

- Contact your insurance company as soon as possible

- Secure the property from further damage

- Contact creditors, banks and appropriate agencies about credit cards, tax returns, Social Security cards or other papers that may have been scattered in the disaster

- Check your credit report to make sure nobody is using your personal information

- Be very wary of fly-by-night work crews and contractor fraud

Download and print your copy of these Wildfire Preparation Tips here.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters and nurses. Get a quote at 1.800.800.9410 or www.calcas.com.

by California Casualty | Homeowners Insurance Info |

From pulling weeds to cleaning floors, it seems like house work never ends, but it’s a lot easier to tackle before the change of seasons. The warmth of summer is a good time to do maintenance that will prevent damage, prepare your home for winter, and add long-lasting value.

Here are some important mid-summer home maintenance tips:

- Do an energy audit and start fixing insulation and cracks

- Insulate hot water pipes

- Clean patio furniture

- Scrub your concrete

- Inspect and reseal decks

- Patch concrete and asphalt cracks

- Prune or remove problem trees and shrubs

- Clean exhaust fans

- Fix the fence

- Make your landscaping “critter proof” (deer, rabbits and other animals can cause thousands of dollars of damage to your plants and trees)

Doing regular maintenance can not only protect your home, but it can enhance the value of your largest investment. Most realtors and home repair experts say simple projects can add thousands of dollars to your home’s worth. Here are some tips that give the best payback:

- Clean and reduce the clutter around your home

- Spruce up your yard

- Repaint the interior and exterior

- Upgrade your lighting and light switches

- Add wood trim

Don’t forget another vital piece to preserving your home and all the things that come with it; insurance. Now is the time to get a home insurance update and policy review to make sure your precious items are fully covered at the best value. Have you made improvements that could land you big discounts? Call a California Casualty advisor today for a no hassle policy review at 1.800.800.9410, or visit www.calcas.com.

For more information visit:

https://bit.ly/2jMXf9c

https://bit.ly/2jK7Y4c

by California Casualty | Homeowners Insurance Info, Safety |

The recent large earthquakes in Southern California are a reminder to always be earthquake-ready.

Earthquakes come on suddenly, with very little warning. They can be a sharp jolt followed by the ground shaking and cracking, or waves rolling across the ground.

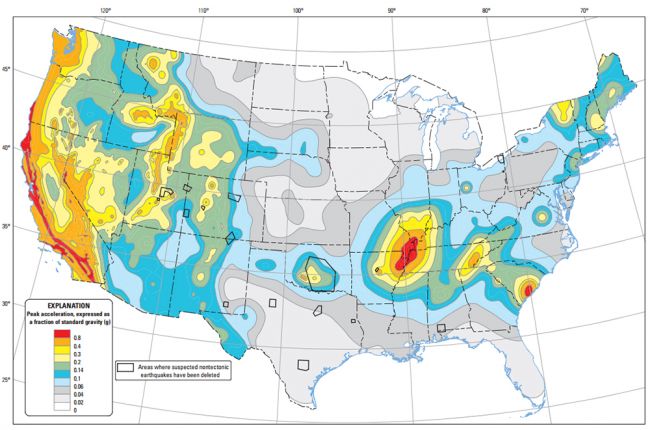

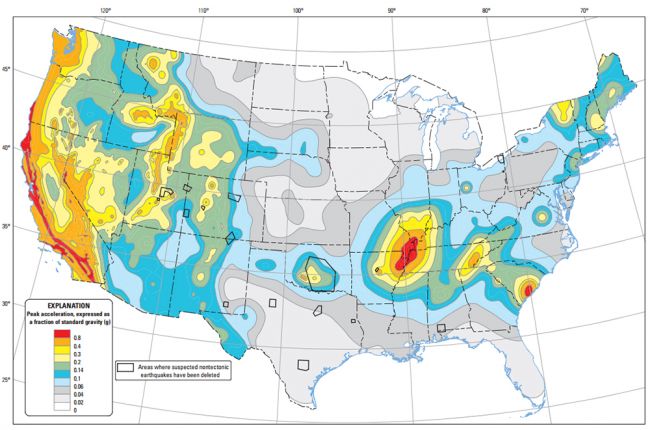

Earthquakes can hit anywhere at any time, and while the West Coast is considered “earthquake country,” the U.S. Geological Survey warns that earthquakes have been registered in every state in the union, with special seismic hazards for areas encompassing the western-third of the nation, and areas extending from Missouri and Illinois to most of the Eastern Seaboard.

After an earthquake strikes many are often left disoriented and full of adrenaline –psyche and security shaken as much as their house. Post-quake your home or apartment may look damage-free, but there can be many hidden dangers.

After checking your family and others for injuries, here are key steps you need to take to ensure your safety:

- Check for gas and water line leaks. Know where the shutoff valves are if you smell gas or detect water leaking to prevent fires and water damage.

- Be aware of downed power lines.They can still carry a dangerous current.

- Inspect chimneys and brick areas for cracks. If cracked, they could send dangerous debris down on you or others.

- Check water heater and furnace vents. If they have become separated, it could send dangerous carbon monoxide into the home.

- Watch for electrical sparking or the smell of burning wire insulation. This could lead to a fire. Unplug any broken lights or appliances and turn off power at the main fuse box if you detect an issue.

- Clean up spilled medicines, drugs or harmful chemicals. Bleach, turpentine, hazardous garden supplies, etc.

- Don’t drink from faucets or other unprotected water sources. Wait until given the okay from your municipality or utility, because they could be contaminated.

Always Plan Ahead

Before an earthquake, or other natural disaster hits, you should always have a plan. Here are some tips to help you and your family prepare:

- Develop a family communication plan and “meet-up” location if you become separated

- Have your first aid kit fully stocked

- Prepare an emergency kit with: water, medicines, food, money, other important documents, etc.

- Have basic emergency supplies gathered all in one place: flash lights, batteries, blankets, a radio, lighters or matches, cell phone chargers, extra clothes

- Be sure to have coverage insurance.

If you have comprehensive coverage with your auto insurance, your vehicle is covered for damage from falling debris and other impacts from earthquakes.

However, earthquake damage is not covered under your homeowners or renters insurance policy, and less than 20% of Americans have purchased a policy. That means most people whose property suffers losses from a temblor will be paying out of pocket or relying on federal assistance and loans for recovery.

You can be prepared; California Casualty provides earthquake insurance as an endorsement to home owners policies in California, Illinois, Kentucky, Missouri, Oregon and Rhode Island. We also offer earthquake coverage through our partner, GeoVera Insurance Company, in California, Oregon and Washington. Learn more and get a quote at 877.652.2638 or visit www.calcas.com/earthquake-insurance.

For more information visit:

https://bit.ly/2Xz4Db6

https://bit.ly/2XVRckI

https://bit.ly/2S53H8k

by California Casualty | Homeowners Insurance Info |

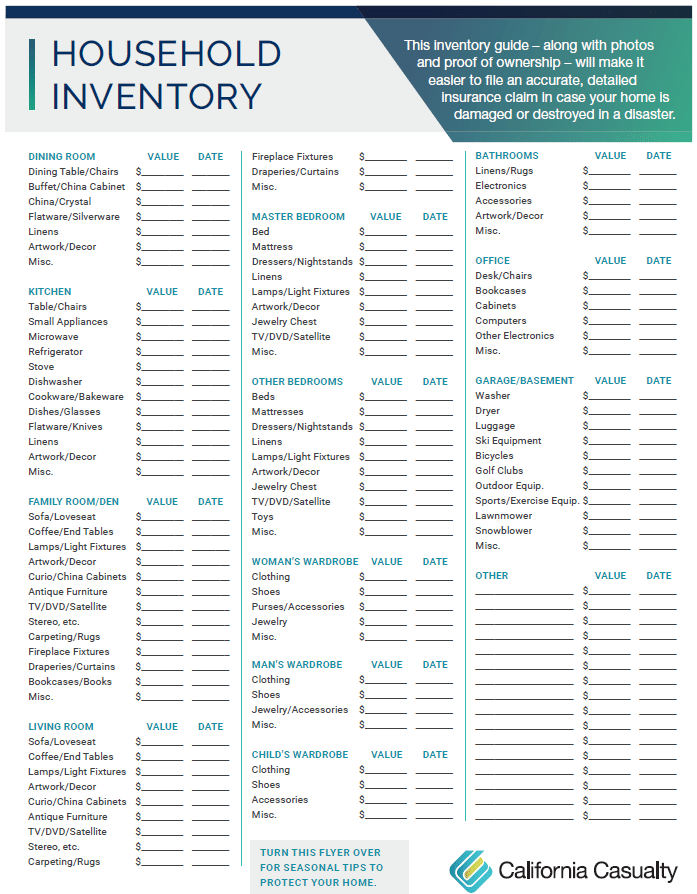

If you are one of the almost 50% of U.S. households that has never completed a home inventory there is no time like the present.

Why is a Home Inventory Important?

A Home Inventory Checklist is a list of your valuable objects in case there is a fire, destructive storm or if someone breaks in and steals your belongings. Doing a home inventory is very important because without one many people have a difficult time pinpointing or recalling everything that might have been destroyed or taken, and unfortunately that can delay claims or keep you from getting full compensation. So, before the hectic holiday season rolls around, and take the time to take inventory of your home.

Just go room by room and document:

- Electronics

- Personal care items

- Jewelry

- Art

- Kitchen items and appliances

- Furniture

- Carpeting

- Beds and linens

- Clothing

- Sports equipment

- Yard and garden tools

You can choose to write everything down or use photo/video documentation of your belongings. Don’t forget to take pictures of the exterior of your home as well (photos are best from all angels- including the landscaping and any decks or porches). Also take note of everything in the garage, attic, or basement- like holiday ornaments, lawn and yard equipment, tools, etc.

Trying to tally what needs to be replaced is not something you want to do in the event of a claim, so completing your inventory will give you some peace of mind if the worst should happen; and you can use the time to get rid of the old and make room for the new, before the craziness of the holidays.

To help you out, we’ve got a handy home inventory guide already made just for you! You can download it by clicking on the “Household Inventory” image below.