by California Casualty | Homeowners Insurance Info, Safety |

The recent large earthquakes in Southern California are a reminder to always be earthquake-ready.

Earthquakes come on suddenly, with very little warning. They can be a sharp jolt followed by the ground shaking and cracking, or waves rolling across the ground.

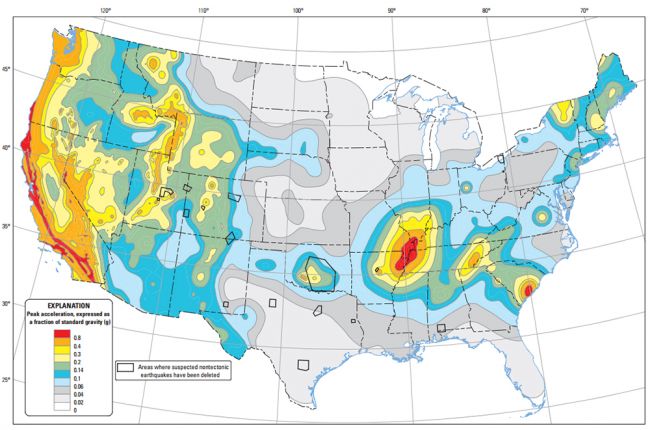

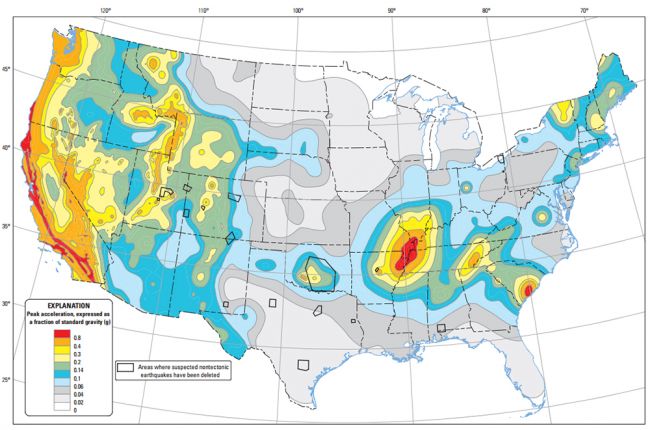

Earthquakes can hit anywhere at any time, and while the West Coast is considered “earthquake country,” the U.S. Geological Survey warns that earthquakes have been registered in every state in the union, with special seismic hazards for areas encompassing the western-third of the nation, and areas extending from Missouri and Illinois to most of the Eastern Seaboard.

After an earthquake strikes many are often left disoriented and full of adrenaline –psyche and security shaken as much as their house. Post-quake your home or apartment may look damage-free, but there can be many hidden dangers.

After checking your family and others for injuries, here are key steps you need to take to ensure your safety:

- Check for gas and water line leaks. Know where the shutoff valves are if you smell gas or detect water leaking to prevent fires and water damage.

- Be aware of downed power lines.They can still carry a dangerous current.

- Inspect chimneys and brick areas for cracks. If cracked, they could send dangerous debris down on you or others.

- Check water heater and furnace vents. If they have become separated, it could send dangerous carbon monoxide into the home.

- Watch for electrical sparking or the smell of burning wire insulation. This could lead to a fire. Unplug any broken lights or appliances and turn off power at the main fuse box if you detect an issue.

- Clean up spilled medicines, drugs or harmful chemicals. Bleach, turpentine, hazardous garden supplies, etc.

- Don’t drink from faucets or other unprotected water sources. Wait until given the okay from your municipality or utility, because they could be contaminated.

Always Plan Ahead

Before an earthquake, or other natural disaster hits, you should always have a plan. Here are some tips to help you and your family prepare:

- Develop a family communication plan and “meet-up” location if you become separated

- Have your first aid kit fully stocked

- Prepare an emergency kit with: water, medicines, food, money, other important documents, etc.

- Have basic emergency supplies gathered all in one place: flash lights, batteries, blankets, a radio, lighters or matches, cell phone chargers, extra clothes

- Be sure to have coverage insurance.

If you have comprehensive coverage with your auto insurance, your vehicle is covered for damage from falling debris and other impacts from earthquakes.

However, earthquake damage is not covered under your homeowners or renters insurance policy, and less than 20% of Americans have purchased a policy. That means most people whose property suffers losses from a temblor will be paying out of pocket or relying on federal assistance and loans for recovery.

You can be prepared; California Casualty provides earthquake insurance as an endorsement to home owners policies in California, Illinois, Kentucky, Missouri, Oregon and Rhode Island. We also offer earthquake coverage through our partner, GeoVera Insurance Company, in California, Oregon and Washington. Learn more and get a quote at 877.652.2638 or visit www.calcas.com/earthquake-insurance.

For more information visit:

https://bit.ly/2Xz4Db6

https://bit.ly/2XVRckI

https://bit.ly/2S53H8k

by California Casualty | Safety |

School is ending and the heat of summer is starting to set in. That means vacations, barbecues, and lazy days on the lake. But for teen drivers, summer means something altogether different. Memorial Day through Labor Day is considered the “100 Deadliest Days” for teenage drivers.

Teen drivers don’t have the best record when it comes to being on the road. Reckless and distracted driving is the number #1 killer of teens in America ages 15-20, but the number of teenage wrecks skyrockets in the summer. On average 10 teens die EACH DAY. That is about 1000 teen deaths each year from May-September, a 26% increase from other months of the year.

Kids are out of school and on the road searching for freedom. They may feel like their responsibilities have been left behind in the classroom. Here are some key factors that lead to teen wrecks and how you can work to help prevent them:

Distracted driving is not just texting and driving. It can come in all forms: phone calls, social media, the radio, eating, applying make-up, or having someone in their passenger seat. Teen drivers are inexperienced when it comes to being behind the wheel, which makes them more susceptible to distraction.

As a Parent What Can You Do?

- Educate your teen on US and state laws set for distracted driving, and teach them about becoming a defensive driver instead.

- Set your own rules and guidelines for distracted driving complete with punishments that would restrict their driving privileges if they are caught driving distracted.

- Don’t be afraid to scare them with real stories and statistics about distracted driving.

- Lead by example. Your children are always watching and will pick up on your bad habits, so make sure you always have two hands on the wheel and your eyes on the road.

Factor #2: Impaired Driving

Impaired driving can be all of the following: driving while under the influence of drugs or alcohol, driving at night or during times of low visibility, or driving while tired. Summer parties and later curfews open the window even more for impaired driving accidents during the summer.

As a Parent What Can You Do?

- Educate your teen on US and state laws set for teenage drug and alcohol use and their consequences.

- Set time restrictions for when they can and cannot be on the road. Driving while overly tired can be just as bad as driving drunk.

- Let your teen know that you are available in a crisis. If your child is in a situation in which they question their ability to drive safely, let them know you can pick them up instead of trying to drive home on their own impaired.

Speeding accounts for about 1/3rd of all fatal accidents in teens, and the problem continues to get larger each year. As teens get more driving experience and gain more confidence they are more inclined to speed, especially on residential roadways.

As a Parent What Can You Do?

- Start the conversation about driving safely and wearing their seatbelt earlier, before your teen is old enough to get behind the wheel.

- When your teen first starts driving spend a lot of time in the car with them, monitoring their speed and educating them on US and state laws.

- Set a good example and never speed with or without them in the car.

- If purchasing a vehicle for your teen driver avoid sports or high-performance cars and look at something a little more large and sturdy.

There is nothing scarier than handing over the keys for the first time and watching your teen drive away by themselves. But by taking the appropriate steps, you can rest a little easier knowing that you have prepared your child for the road and the responsibilities that come with getting behind the wheel.

A great resource for parents to learn more information about Teen Driving is Impact Teen Drivers. The nonprofit educates teens about the deadly consequences of distracted driving. They offer evidence-based, peer-to-peer programs and information to empower young drivers to make good choices behind the wheel. They also hold a twice a year Create Real Impact contest, rewarding students ages 14-22 for their creative messages discouraging distracted driving.

California Casualty is committed to making our roadways safer and we are a major sponsor of Impact Teen Drivers. We urge you to protect your teens and learn more at https://www.whatdoyouconsiderlethal.com/

You can also have your teen take the pledge against reckless and distracted driving, by clicking HERE.

by California Casualty | Homeowners Insurance Info, Safety |

It’s time to brush off your barbecue grills, stock up on popsicles, and get a new swimsuit because summer is practically here! After a winter with too much snow and a spring with too much rain, we are more than ready for summer. And if your neighborhood is anything like ours, then the arrival of summer means one thing: water safety tips

POOL SEASON!

In the excitement of summer, it’s tempting to just throw on a suit and jump on in the water. But wait…for most of us, it’s been about a year since we dipped our toes in the water. Now that may not seem like a long period of time, but for young children, it could mean life or death.

Pool Safely, a national public education campaign that works to reduce child drowning, states that drowning is the leading cause of unintentional death in children ages 1-4. However, these deaths can easily be prevented by taking action and learning how to keep your child safe when enjoying the water. So before you and your family cannonball in make sure you review these

9 simple Water Safety Tips:

“Drowning is the leading cause of unintentional death in children ages 1-4.”

1. Maintain constant supervision whenever children are in or near water.

Never leave kids unattended, avoid all distractions, and if a child is missing check the pool first.

2. Teach your child how to swim or give them a life jacket.

Floaties or other inflatables are not life jackets and should never be substituted for adult supervision.

3. Teach children to stay away from drains, pipes, and other openings to avoid entrapment.

Make sure all drains and pipes are covered before letting your child get into the water.

4. Never let your child swim alone.

Always keep an adult present, do not trust your child’s life to another child.

5. Teach your kids the “Rules of the Pool”.

Set ground rules for being in the pool, like only getting in at certain times and no pushing or diving.

6. Keep your pool clean and clear with the proper chemicals.

You will be able to clearly see what is happening in your pool, and minimize the risks of earaches, rashes, and diseases.

7. Create barriers for your pool that will reduce the risk of a slip or fall.

Isolate your pool from your home with a fence or locked gate and keep toys away from the pool.

8. Educate yourself on what real drowning looks like and how to spot it.

Real drowning can be quiet and easy to miss.

9. Learn CPR and know when to call 9-1-1.

Have a plan in place with your children on what to do during a water emergency.

Summer is a time of relaxation and you enjoy it. But remember, it only takes one second for your child to go under the water. Take action by educating yourself and your children to make sure everyone is prepared with the right skills and equipment before hitting the pool, to ensure a fun and safe summer break! Click here to learn more about Pool Safely’s tools and educational materials for water safety.

And don’t forget! There are insurance implications for those with pools. Accidents happen so frequently, having one is considered an “attractive nuisance,” increasing liability risk. Because of the increased danger, the Insurance Information Institute says pool owners may want to increase their liability coverage to at least $300,000 or $500,000.

Don’t let it break your bank, if you have a pool make sure you have sufficient liability coverage from your homeowner’s insurance. Call a California Casualty advisor today for a policy review, 1.800.800.9410 or visit www.calcas.com.

Cannonball away!

More information for this article can be found at:

https://bit.ly/2WdfFSx

https://bit.ly/2XbA0nS

https://bit.ly/2Kcnu3K

by California Casualty | Auto Insurance Info, Safety |

May 24 is National Road Trip Day!

As May comes to a close, classes are ending, the days are getting longer, and temperatures are slowly beginning to rise. You know what else that means? Vacation. Summer is calling and many American families are planning to spend their free time on the road relaxing and enjoying the sun.

Traveling, in all forms, is at its peak in the summer months. Road tripping and RV-ing are currently on the rise, so much so that Fox News reports that 73% of Americans would rather road trip than fly. Aside from all of the scenic views that are available when traveling by vehicle, travelers feel a sense of freedom by land, with the knowledge that they can stop or change their destination at any point in time instead of following a strict schedule like you would in an airport.

Whether your destination is the beach, the mountains, or just the open road, it is critical that your vehicle is ready to make the journey with you. So before you jam all of your luggage in the trunk, be sure to check the following in preparation for your summer road trip adventure:

-

Periodically check and test batteries for proper charging. Summer heat drains batteries faster than the cold of winter.

-

Check the air conditioning system for leaks and proper coolant.

-

Check the tires for tread and proper inflation.

-

Be sure your cooling system has the proper anti-freeze/coolant and all belts, hoses and the water pump are properly working. Never open a hot radiator cap; the liquid inside is a scalding 200 degrees or hotter.

-

Verify the viscosity of your motor oil will stand up to hot weather days, 10W-30 or 10W-40.

-

Make sure the spare tire is inflated and there is a jack and tire changing tool.

-

Test your windshield wipers and change them if they are streaking.

Consumer Reports advises that, as well as checking your vehicle before leaving for your destination, you should also travel with a basic safety kit that consists of:

- Cell phone and spare battery

- First aid kit

- Fire extinguisher

- Warning light or reflective triangles

- Tire gauge

- Jumper cables

- Foam sealant for flat tires

We don’t like to think that things could go wrong on vacation, but you never know what you will run into on the open road and that is why it is important to be prepared. Here at California Casualty we proudly support our customers and want you all to have a fun and safe summer full of road trip adventures, so before you hit the road, make sure that you and your vehicle are adequately protected for the unexpected you may encounter far from home.

Current customers call a California Casualty advisor for an auto policy review at 1.800.800.9410 or visit mycalcas.com/customerservice. If you are not a customer please contact us 1.866.704.8614 or visit www.mycalcas.com to request a FREE Auto Insurance quote.

Where do you plan on traveling this summer? Or do you have a dream road trip destination? Comment below and give us ideas for our summer travels! And if you are wanting to hit the road, but need a little help as to where check out Fox New’s Top 15 things to do on America’s travel bucket list.

Happy Travels!

More information for this article can be found at:

https://fxn.ws/2Ev0SYm

https://bit.ly/2K2jq5Y

by California Casualty | News, Safety |

Students and schools across the country have won educational grants from the 2019 Spring Create Real Impact Contest, sponsored by Impact Teen Drivers and California Casualty.

A total of $12,000 was awarded for creative efforts to address the dangers of distracted driving aimed at teenagers.

Caden Turner – “Listen Up”

The students chosen for $1,500 grand prize educational grants:

- Ashlee Walkowiak, Franklin, WI, in the writing category for her work titled, “Be Different”

- Everen Graves, San Diego, CA, in the music category for the song “So Much to Live For”

- Caden Turner, St. Louis, MO, in the video category for “Listen Up”

- Lindsey Sanchez, Richmond Hill, GA, in the art category for the poster “Camera Filter”

The schools with the most entries that were each awarded $1,000 are:

- Village Academy of Film, Pomona, CA

- University City High School, San Diego, CA

- South Forsyth High School, Cumming, GA

The contest encourages peer-to-peer messages and creative expression from students. The goal – help stem the tide of distracted and reckless driving, which is the number one killer of young drivers.

Preventing inattentive driving, especially among teens, is one of the top priorities of the National Highway Traffic Safety Administration, and safety groups across the nation.

“The objective of the Create Real Impact Contest is to allow young people to engage, educate and empower their peers with strategies to stop the number one killer of teens – car crashes – particularly those caused by reckless and distracted driving,” said Kelly Browning, Ph.D., Executive Director, Impact Teen Drivers. “The contest meets teens in a space where they are comfortable – online. It is about the solutions to ending distracted driving, #EndDD, #WeHavethePower.”

Students ages 14-22 were invited to offer their artistic solutions to this critical teen driving danger through essays, artwork, videos and music. More than 1,300 submissions were received and winners were determined by a panel of judges and by online voting for prizes ranging from $500 to $1,500.

Impact Teen Drivers has reached more than two million teens since 2007 and the Create Real Impact contest began in 2009. California Casualty is a founding partner of the nonprofit and continues to provide support for the contest. California Casualty representatives will help present checks to the winning schools and awardees.

“The importance of this contest can’t be overstated,” said California Casualty CEO Beau Brown. “While insurance can replace a mangled vehicle, we can’t replace a teenager’s life. In a split second, everything for that family changes forever; it’s a terrible tragedy that no one should endure.”

The 2019 Fall Create Real Impact contest will kickoff in August. Entries will be taken at www.createrealimpact.com. For more information on how to get schools and students involved, please contact [email protected].

by California Casualty | Pets, Safety |

Spring break will be here before you know it and summer is right around the corner. If your plans include travel and Fido isn’t invited, here are a few things to consider when deciding where and who will care for your four-legged family member while you’re away. boarding your pet

Before Boarding Your Pet, Plan to Ask:

-

Is my pooch up to date on vaccinations?

Ensure vaccinations are required for other animals boarded in the same facility.

-

Can I take a tour?

Visiting the facility and meeting staff members who will be caring for your dog can help you determine if it’s the right fit. Plus, provides peace of mind while you’re away.

-

Are the staff and facility certified?

If your dog is injured, know who will provide treatment. Also, find out if your pet will need to be transported to another location for care.

-

What will my dog do all day?

Some places keep dogs kenneled most of the day. Alternatively, others provide an open area for dogs to play and socialize with other pet guests.

-

Where will my dog sleep?

Just like time spent during the day, some facilities require pets each sleep in a separated area. Others offer a slumber party environment.

-

Can I bring my own dog food?

Let the facility know if your dog has a special diet or feeding schedule.

Whether you use these as a starting point or have your own questions, the most important thing is that you feel comfortable knowing you’ll return to a pet that is tired but happy. boarding your pet

We know how important your furry friends are. That’s why California Casualty offers pet health insurance from Pets Best, rated in the top tier of pet insurance companies. You can get up to 90 percent reimbursement for X-rays, lab tests, surgeries, even cancer treatment with a Pets Best policy. Best yet, you’ll save five percent (in most states) if you purchase through California Casualty.

We only get limited time with our pets. Make the most of it! Contact our Agency Services team at 1.877.652.2638 or email [email protected].

If your pet travels with you, don’t forget California Casualty automatically includes free Pet Injury Coverage as part of your auto insurance policy.

Get a free quote today and discover why educators, firefighters, police officers and nurses trust California Casualty for their auto and home insurance needs. www.calcas.com