by California Casualty | Safety |

It’s official, guys.

It is Hurricane Season.

Okay, so it’s been hurricane season. The 2012 Atlantic and Caribbean hurricane season began on June 1 and ends November 30. The Eastern Pacific hurricane season kicked off May 15 and wraps up November 30.

So maybe we’re a little late to the party.

But according to FEMA, peak hurricane season is right around the corner: running from mid-August to October.

According to the National Hurricane Center, it’s nearly impossible to determine a storm’s approach any sooner than 5 or 7 days in advance.

If you had only 5 days warning, would you be ready?

Between 1970 and 1999, more people lost their lives from freshwater inland flooding associated with tropical cyclones than from any other weather hazard related to such storms. (https://www.ready.gov/hurricanes)

Protect yourself. Protect your family. Protect your home.

There is plenty you can do BEFORE a storm even hits. So next time you have a few hours on a Sunday, work on preparing your home for the risk of a hurricane. Here are some tips:

Before a Hurricane:

- Build an emergency kit. Tips for building the kit can be found here

- Learn the elevation of your property and whether it is flood-prone

- Study community hurricane evacuation routes

- Know where you would go if a hurricane hit

- Make a plan on how to evacuate. A downloadable Family Emergency Plan can be found here. Print it off and complete it.

- Practice your plan

- Develop a plan for your pet. A great list of steps and supplies from the Federal Alliance for Safe Homes (FLASH) can be found here.

- Don’t forget about your business. Hurricane preparation does not end at home. Here is a great Business Survival Plan from the National Hurricane Survival Initiative

- Pay attention to the news. Know the guidelines of when you should evacuate and when you should stay. A good guide from the National Hurricane Survival Initiative can be found here.

- Cover all your home’s windows.

- Brush up on your watches and warning terms. That way, you’ll understand the risk and can better make safety and evacuation decisions. A good review from FLASH can be found here.

- Install straps or clips to securely fasten your roof to your frame structure to reduce wind damage

- Keep trees well-trimmed

- Clear loose/clogged rain gutters

- Reinforce garage doors

- Bring in ALL outdoor furniture, decorations, garbage cans and similar items that are not tied down

- If you live in a high rise, prepare to take shelter on or below the 10th floor

- Print out and LAMINATE (to protect from water), tips for what to do during and after a hurricane and put them with your safety kit. You can find “during and after a hurricane” tips here.

- Check your property insurance policy for appropriate coverage. Here’s some information on California Casualty’s coverage and here’s some information on flood insurance an important factor in Hurricane recovery.

As peak Hurricane season begins, make sure you are ready for possible storms. Your safety is our top priority.

Here are some additional resources we recommend:

- The Federal Alliance for Safe Homes (FLASH) has a fantastic site on disaster preparedness. They have great resources, checklists and plans for preparing your home and family for a hurricane.

- The National Hurricane Survival Initiative offers another great checklist for your safety kits, and most of their forms are downloadable! Check them out here.

- The National Weather Service’s National Hurricane Center is a great place to monitor hurricane weather as it develops. They also have good preparedness resources and can help you find your local emergency management office

by California Casualty | Homeowners Insurance Info |

Hurricane season is here, and with it comes the risk of damaging storms in coastal areas. While your primary goal should be emergency supplies and an evacuation plan to keep you and your family safe, there are also some steps to take to protect your home from catastrophic damage.

One of the biggest keys to protecting your home from damage is to secure the windows. Why is this important? For one, once the windows shatter, the high winds enter the house, wreaking havoc and causing interior damage. The most important reason is that as hurricane winds blow into the house, it creates upward pressure on the roof. This pressure may be enough to blow the roof off – which will likely lead to the total destruction of your home.

The ideal way to protect your windows is to install heavy duty wood or metal storm shutters. This can be quite an investment, but one that will pay off in protection, as well as the ability to quickly respond to the threat. Alternatively, you can use marine plywood attached to your home’s exterior. It is recommended that you have these pieces purchased, cut, and pre-drilled/ready to install before a hurricane watch is in place. If you wait until danger is bearing down on you, it may be too late.

Some other tips to protect your home during a hurricane:

- Remove dead trees or tree limbs on your property

- Be aware if your home is in a storm surge danger area

- Create a “safe room” in your house

- Keep battery powered radios, flashlights, and extra batteries on hand.

by California Casualty | Safety |

Hurricane season is upon us, after a violent spring storm season. Hopefully, we’ve seen the worst of the severe weather for the year, but it pays to be prepared.

The NWS National Hurricane Center has some great resources for learning more about hurricanes, their dangers, and safety precautions you should take.

It will help you identify the main questions you need to be able to answer if you are in a hurricane prone area:

- What are the Hurricane Hazards?

- What does it mean to you?

- What actions should you take to be prepared?

You should also consider calling your insurance agent or customer service department to make sure you have the appropriate coverage in case disaster strikes!

by California Casualty | Helpful Tips, Travel |

Get your gear ready. It may be winter, but it’s a great time to go camping. Not only will you find comfortable temperatures, but you’ll also enjoy spectacular scenery, lower costs, and fewer crowds. Here are some of our favorite destinations for winter camping.

ARIZONA

Twin Peaks Campground

https://www.nps.gov/orpi/planyourvisit/twin-peaks.htm

Sonoran Desert, Arizona (2 hours from Phoenix)

Cost: Starting at $20 per night plus a $25 entry fee into the park

Average winter temperatures: Daytime highs in the 60’s to low-40’s at night

What you need to know: This is the main campground for the Organ Pipe Cactus National Monument. The area is surrounded by desert plants and cacti and has numerous hiking trails.

CALIFORNIA

Joshua Tree National Park

https://www.nps.gov/jotr/planyourvisit/jumbo-rocks-campground.htm

Jumbo Rocks Campground

Twentynine Palms, California

Cost: $20 per night plus entrance fee

Average winter temperatures: Daytime temperatures average 60 degrees with freezing nights

What you need to know: There are several campsites at Joshua Tree National Park. The Jumbo Rocks is centrally located and offers beautiful views of the rock formations. The park is known for hiking, climbing, and stargazing. Pets are not allowed on trails. Make your reservation early; the park is busiest during February and March.

FLORIDA

Everglades National Park

https://www.nps.gov/ever/planyourvisit/camping.htm

Homestead, Florida

Cost: Starting at $33 a night

Average winter temperatures: Range from high 50’s to high 70’s

What you need to know: This park features towering Cyprus trees and an abundance of animals who call the Everglades home. Choose from front country and wilderness back country campsites, the latter reached mostly by canoe, kayak, or motorboat. Reserve early as this park is busiest from November through April.

GEORGIA

Reed Bingham State Park

https://gastateparks.org/ReedBingham

Adel, Georgia

Cost: From $35 per night plus $5 parking fee

Average winter temperatures: Low 40’s to mid-60’s

What you need to know: This park features a 375-acre lake, and there are rentals for canoes and kayaks. Visitors also enjoy fishing, birding, and hiking. There is abundant wildlife, including tortoises, snakes, alligators, and nesting bald eagles. During the winter, thousands of black vultures and turkey vultures make their home here.

LOUISIANA

Grand Isle State Park

https://www.lastateparks.com/parks-preserves/grand-isle-state-park

Jefferson Parish, Louisiana

Cost: Starting at $18 per night plus $3 per person admission fee

Average winter temperatures: mid-40’s to mid-60’s

What you need to know: This park offers fishing, birding, crabbing, hiking, and boating throughout the lagoons and the Gulf shore. There is a toll bridge to get to this state park. While the park is open, the boardwalks are currently closed due to damage from Hurricane Ida and campsites are limited.

NEVADA

Valley of Fire State Park

https://parks.nv.gov/parks/valley-of-fire

Overton, Nevada

Cost: $20 per night for Nevada residents and $25 per night for non-Nevada vehicles, an additional $10 for utility hookups (WiFi for an additional fee)

Average winter temperatures: Can range from freezing to 75 degrees so pack accordingly

What you need to know: This 40,000-acre park is known for its bright red Aztec sandstone and its ancient, petrified trees and petroglyphs dating back more than 2,000 years.

OREGON

Harris Beach State Park

https://stateparks.oregon.gov/index.cfm?do=park.profile&parkId=58

Brookings, Oregon

Cost: Starting at $20 per night for residents (non-residents pay 25% more)

Average winter temperatures: Mid-50’s in the day to low-40’s at night

What you need to know: While winter is not beach weather, this park includes a beautiful beach for strolls, as well as walking paths and hiking trails. There are tent sites, RV sites, and yurts. Some of the campsites are closed during the winter so please check before you book.

SOUTH CAROLINA

James Island County Park

https://ccprc.com/68/James-Island-County-Park

Charleston, South Carolina

Cost: Starting at $35 per night campgrounds and cottages are available

Average winter temperatures: Mid-40’s to low-60’s

What you need to know: The 643-acre park features open meadows and miles of paved trails for walking, biking, and skating. While the Splash Zone is not in operation during winter months, there is a climbing wall and disc golf course. Not only is the park pet-friendly, it also features a dog park.

TEXAS

Enchanted Rock State Natural Area

https://tpwd.texas.gov/state-parks/enchanted-rock

Fredericksburg, Texas

Cost: Starting at $14 per night plus a day pass fee of $8 per person; no RV or vehicle camping

Average winter temperatures: Daytime highs of mid-60’s to nighttime lows of low-40’s

What you need to know: The park features a huge pink granite dome that gives it its name. There is 1,600 acres of desert landscape, including opportunities for hiking and rock climbing. Pets are limited to one trail, and there is no bike riding on any trails.

UTAH / COLORADO

Dinosaur National Monument

https://www.nps.gov/dino/index.htm

Jensen, Utah

Cost: Camping starts at $0 in the backcountry and ranges from $6-$40 at other sites plus an entrance pass ranging from $15-$25

Average winter temperatures: Elevations in the park may influence temperatures which can fluctuate from 0 degrees to 30 degrees in January. Pack accordingly.

What you need to know: This is your chance to camp where dinosaurs once roamed. The park covers 210,000 acres at the intersection of Utah and Colorado, and offers hiking, river rafting, and petroglyph viewing. Six campgrounds provide a variety of options. Not all are open in the winter. There are places where pets are permitted and where they are not.

Do you have a favorite winter camping spot? Share it in the comments.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info, Finances, Homeowners Insurance Info |

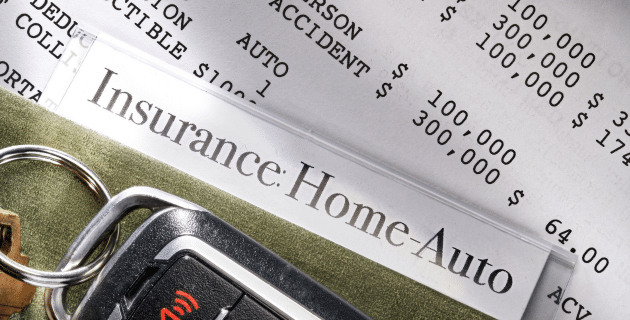

Insurance policies may seem like they’re written in another language. Yet it’s important to understand the terms so you can get the most out of your coverage. Here’s a quick tutorial on deductibles and what they mean for your auto and home insurance.

What is a deductible?

Simply put, a deductible is the amount of money that you pay out-of-pocket before insurance kicks in. Generally, your insurer deducts the deductible amount from the payment that they make on your claim. You can find the deductible listed on the declarations page, which is the front page of your policy.

Example: If the cost of a repair is $1,500 and your deductible is $500, insurance will cover $1,000.

Unlike health insurance deductibles, you do not have to reach an annual amount in an auto or home policy before insurance will pay. Each time you file a claim, there is a deductible (if it applies). One exception is the state of Florida where hurricane deductibles are once per season.

High vs. Low Deductibles

You select your deductible from a range of choices provided by your insurer. If you choose a lower deductible, that means your insurer will need to cover more in the event of a claim, which will raise the cost of your policy. If you choose a higher deductible, you’re willing to cover more of the cost in a claim, and that will lower your premium.

Lower deductible = Higher insurance premium

Higher deductible = Lower insurance premium

It’s important to note that you will have to pay the deductible if a loss occurs in a car accident, even if you think the other driver is at fault.

You may think twice about filing a claim for a damage amount that is close to your deductible. For example, if your deductible is $1,000 and repairs are $1,250, it may not be worth it. You’d be responsible for the bulk of the repairs, and by filing a claim, your rates may go up when you renew. See our blog about when you need to file a claim and when you don’t.

Auto Policies & Deductibles

There are different types of coverage available to you for your vehicle. Some may be mandated by your state or your lender, and others are optional. Not all coverages carry a deductible.

The following coverages include a deductible, and you may choose a different deductible amount for each one:

- Collision: This coverage kicks in when you collide with another car or object.

- Comprehensive: This coverage is for damage from other causes such as hitting a deer or having a tree fall on your car.

- Uninsured motorist property damage (UMPD): This coverage is for property damage from accidents with another driver who is uninsured and at fault. UMPD may or may not have a deductible; it depends on the state and the type of loss. (Uninsured motorist coverage, which is different than UMPD, does not have a deductible.)

- Personal injury protection (PIP): This coverage pays for medical expenses regardless of who is at fault.

Pro Tip: Being able to set a deductible for each type of coverage allows you to assess the likelihood of your needing that coverage. For example, if you live in the country and might be more likely to encounter a deer than another car, you can lower the deductible for comprehensive and raise the deductible for collision.

There is auto coverage that does not carry a deductible, and that’s liability coverage. With liability coverage:

- If you are at fault: You hit another car and cause property damage and/or driver injuries. Your liability covers the damage to the other driver and his/her car without requiring a deductible. However, your own collision policy pays for damage to your car, which would come with a deductible.

- If someone else is at fault: Another driver hits your car and/or injures you. Their insurance will pay for damages and medical expenses. There are no deductibles.

Your insurer can provide quotes for different levels of deductibles and work with you to determine the best coverage for your budget.

Homeowner’s Policies and Deductibles

Whether you’re buying a new home, or you’ve owned yours for years, your homeowner’s policy protects your investment. Costs vary by location, age of home, construction type, number of bathrooms, and many other factors.

With homeowner’s insurance, there are generally three choices for deductibles:

- Flat deductibles: You would choose a fixed dollar amount, such as $1,000. That is the amount you would pay out-of-pocket before insurance kicks in.

- Percentage deductibles: You would choose percentage of your Coverage A limit. If your policy covers your home at $300,000, and you choose a 2% deductible, you would be responsible for 2% of $300,000 or $6,000.

- Peril-specific deductible option: You could have a flat deductible amount and then carry a different one specifically for wind/hail losses.

There are coverages under your home insurance that do not carry a deductible. These include Scheduled Personal Property (SPP) Coverage, Coverage E: Personal Liability, and Coverage F: Medical Payments to Others.

- Scheduled personal property (SPP) Coverage is for items that have higher values above your personal property coverage limits. This includes heirlooms, watches, jewelry, instruments, furs, or anything about which you are especially concerned such as a special guitar. (Musical instruments for example do not have a contractual limit but you will want to schedule an instrument that is special to you.) SPP offers much broader coverage for your precious items – if you lose a set of earrings, they are covered; if a diamond falls out of a ring, or if a guitar falls off a shelf and gets stepped on, they’re covered. There is no deductible if the covered items are stolen, lost, or damaged. Insurance pays the lowest of the four options: repair, replace, actual cash value or the amount of insurance.

- Personal Liability protects you if a claim is made or a suit brought against you for bodily injury or property damage caused by an occurrence to which coverage applies. These are expenses paid to third parties for their injuries and damages. Liability covers you at your place or anywhere in the world. If you are found liable, the policy will pay up to its limit of liability for damages for which an insured is legally liable. This can include medical expenses, lost wages, pain and suffering, and permanent scarring. The policy also provides a defense in court, if needed, for the policyholder. This is at the insurance company’s own expense.

Insurance may seem complicated, but it doesn’t have to be. Your agent can answer any questions you may have. Contact your insurer to find out more about protecting your most valuable possessions.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.