by California Casualty | Auto Insurance Info |

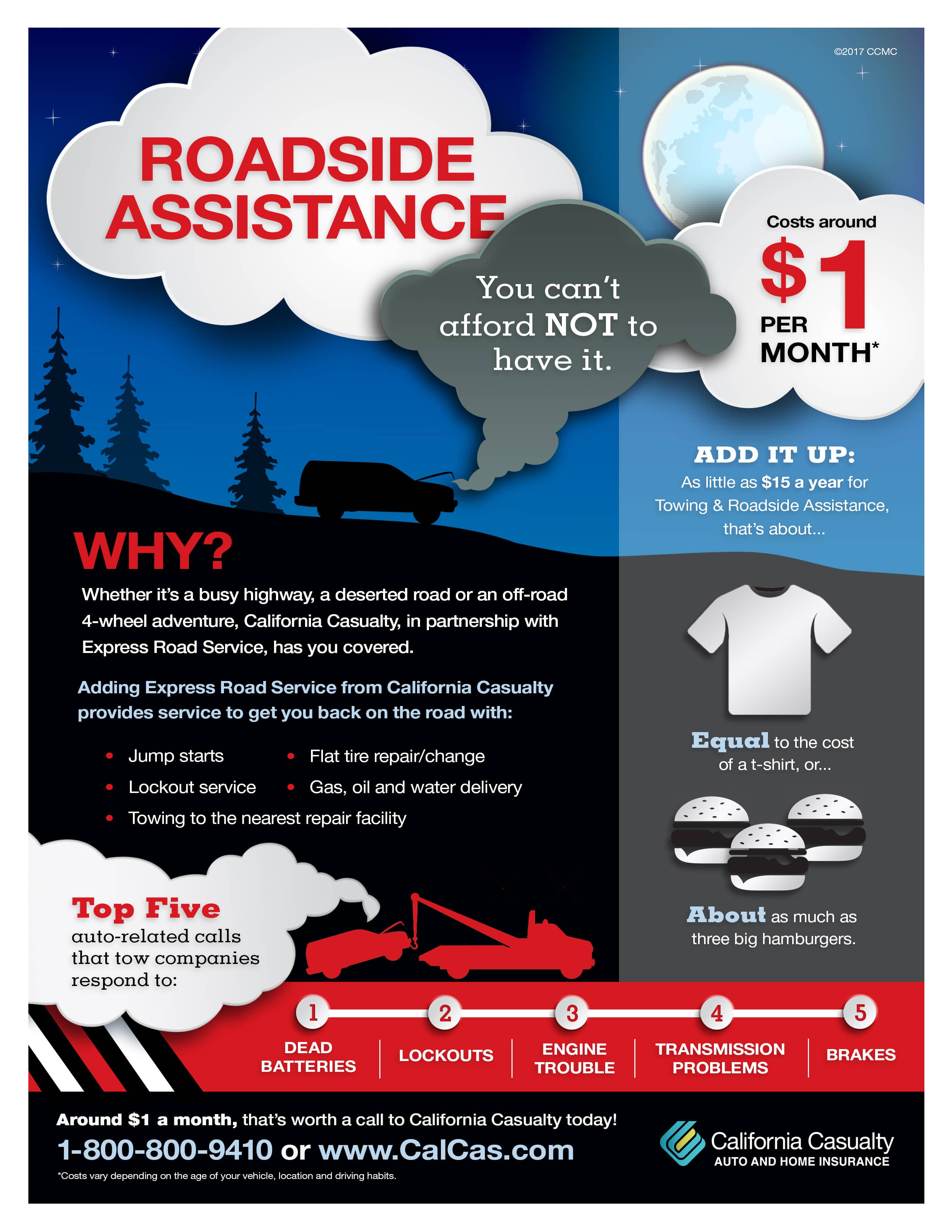

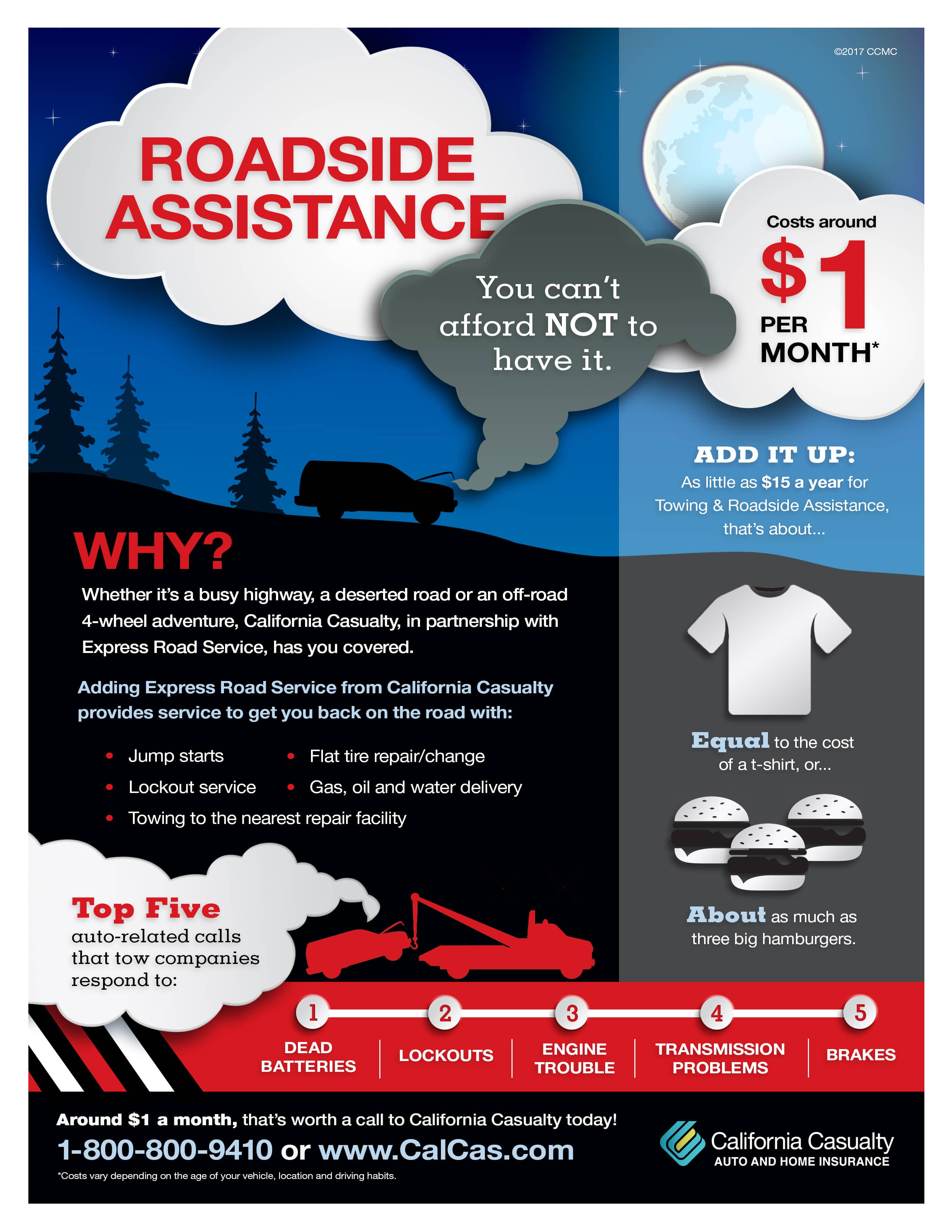

Breaking down on a busy street or highway can be dangerous. Roadside assistance is an add-on coverage that’s at your service 24/7 to help you get back on the road safely if you are left stranded due to an accident or car problems.

Whether you run out of gas, a tire blows out, or you are experiencing any other kind of car or engine trouble, roadside assistance has your back. Instead of spending money on an expensive tow, you can rest assured knowing that you are covered when you choose to add it on to your auto insurance policy.

Plus, when you add roadside assistance to your coverage you will pay as little as around $1 a month. This is a coverage you can’t afford to NOT have!

What Will Roadside Assistance Cover?

When you add- on Express Road Service to your California Casualty auto policy, you will be covered if you need assistance with

- Jump starts

- Lockouts

- Tire repair or change

- Gas, oil, and water delivery

- Towing to the nearest repair facility

And you won’t even have to remember to make additional payments to keep roadside assistance. Your cost of coverage will be rolled into your monthly premium to help make payments more convenient for you.

Talk to your insurance agent to understand what is covered. Ask about additional services and the exclusions and limitations when adding roadside assistance to your policy.

Why Do I Need It?

Roadside assistance offers you fast, reliable service available to you when you need it most. Here’s why everyone should add this coverage on to their auto insurance policy.

- Affordability. With annual prices as low as $1 dollar a month, you won’t even feel like you’re paying for additional coverage. Rates at these prices can’t be beaten even by other big-name clubs or associations like AAA.

- 24/7 hour service. No matter if your car breaks down at 12 a.m. or 12 p.m. you will never be stranded, roadside assistance will come to you at any time of day or night to help service or tow your vehicle.

- Peace of mind. If your car is older, or starts having mechanical issues you can have peace of mind driving to your destination (no matter how far) knowing that roadside assistance is a phone call away.

- Towing. Car tows are very common and can be costly if you do not pay for roadside assistance. The average cost for a car tow without roadside coverage is $109.

- Teen Driver Safety. If your family has a teen driver on the road, as parents you can breathe easier when handing over the keys knowing your young driver can call roadside assistance for help if the unexpected were to happen.

If you have an auto policy without roadside assistance, what are you waiting for? Call and add-on this cheap and essential coverage today at: 1.800.800.9410

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

Express Road Service from California Casualty is just another way we’re there for you when you need us. Check out these amazing benefits for around $1/month.

by California Casualty | Auto Insurance Info, Helpful Tips, Safety |

You gave your teen the keys to the car, and now they’re off. How do you know they’ll be safe on the road? The latest technologies can help. We’ve done a deep dive into some of the most popular driving monitoring apps that can help your teen establish safe driving habits. Here’s what you need to know.

What can apps measure?

- Speed limits: With limited driving experience, your teen may not realize the dangers of driving fast. They may not know how much time it takes to slow down a car. There are apps that set a speed limit and notify you if the driver exceeds that limit.

- Distractions: Distracted driving is an issue for us all but new drivers are especially vulnerable. They may not realize how much can happen if they take their eyes off the road for even a few seconds. Even responding to a phone call or changing playlists can lead to an accident. Some apps set a Do Not Disturb mode when the car reaches a certain speed. If your teen disables the setting, you will be notified.

- Locations: GPS tracking can let you know your teen is where they are supposed to be. Some systems also have a silent alarm so that your teen can signal an SOS if they feel unsafe.

Before you install a driver monitoring app, it’s important to have a conversation with your teen. Make sure you include any other family rules such as the curfew for the car being home, and how you wish your teen to check in with you. Discuss distracted driving and how they should handle calls and texts. In doing so, you are setting up your teen for a lifetime of safe driving.

The Apps

Auto Coach (free)

This app is designed to help parents teach teens how to drive safely. It was developed by the Shepherd Center Hospital in conjunction with the Georgia Governor’s Office of Highway Safety. It includes interactive lessons for teens with cognitive and physical disabilities. The app tracks driving hours and keeps parents involved in the process.

Bouncie (monthly subscription plus one-time device charge)

This offers real-time detailed insights and driving reports on speed, location, idle time, and hard braking. Bouncie also can monitor gas mileage and fuel economy, battery level, oil level and vital alerts. Information is accessible on your smartphone or computer. Bouncie requires a device that plugs into your vehicle. It works for most vehicles made after 1996.

FamiSafe (monthly subscription)

This app goes well beyond safe driving. It also tracks screen time and inappropriate content on kids’ devices. From a driving perspective, the app reports on speed limit, total distance traveled, and real-time physical location. It instantly notifies you if your teen speeds or brakes suddenly. Weekly driving reports help to analyze patterns. You manage all devices from a FamiSafe Dashboard on your smartphone or computer.

Family360 (monthly fee)

This app synchronizes your family into a private “circle.” It tracks everyone’s locations in real time through mobile phones. You can be notified when someone in your circle leaves or enters the places you go to most frequently.

Life360 (free and paid options)

This app offers real-time location monitoring and detailed driving reports. It tracks speeding, hard braking, and in the paid version signals crash detection and sends roadside assistance. It does more than tracking driving, however. The app includes digital monitoring, stolen phone protection, medical assistance, travel support, and disaster response.

On My Way (free)

This app pays you for safe driving. Users get 5 cents for every mile they drive without texting. While they cannot withdraw real cash, your teen can use it toward food, gas, events, travel, and gift cards.

Road Ready (free)

Part of the Parent’s Supervised Driving Program, this app logs the state’s required drive time for learners and tracks driving experiences. It also provides tips for safe driving.

Teen Time: Parental Control (free and paid options)

This is a location app that also monitors screen time and how kids are using their phones. It allows parents to limit use of games and apps. You can use it to track use of devices while your teen is driving.

TrueMotion Family Safe Driving (free)

This app tells you where your family members are and how they got there, with details on exactly how they drove. It records phone use, texting, aggressive driving, speeding, and more.

Finally, make sure that your car is well maintained and fully insured with your teen listed on the policy. Talk to your insurance agent about ways that you can save with a teen driver.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You don’t have to wait for your auto policy to expire to change insurance companies. However, you do need to make sure you’re fully covered without any gaps in insurance. We’ve compiled some guidelines to help you decide if a change is right for you.

When should you think about changing policies?

While you don’t need a reason to change your auto insurance, there are some times when it makes sense for you to revisit your policy—even if you don’t change insurance companies. You may end up modifying your current policy to meet your evolving needs. For example:

-

- If you’ve had a major life change, such as getting married or divorced, you may need more or less insurance.

- If you’ve moved to a new zip code or state, the new location could affect your premium.

- If you’ve become a homeowner, you can bundle your auto and home and save money.

- If you’ve gone from working out of the home to remote work, your annual mileage may be less.

- If you’ve bought a new car, you will want to check insurance policy options.

- If your teenager is about to get his or her license, that will add to your policy.

- If your credit score has improved, you may qualify for a lower rate.

- If you’re unhappy with your current insurer, you can consider a change.

- If you’re approaching your renewal date, you can terminate a contract without cancellation fees.

Follow these steps to make the change.

Step 1: Consider your coverage options.

Figure out how much coverage you need. If you depend upon your care, you want to make sure that you have enough to replace it if necessary. Also, check your state laws. Some states will require you to have certain car insurance. If you lease or finance a car, your lender or lessor will require you to purchase collision and comprehensive insurance.

Step 2: Compare quotes from multiple insurers.

Get quotes from several insurers, and make sure you are comparing the same coverage, limits and deductibles. Sometimes policies are cheaper because they don’t have the same coverage. This is also a good time to contact your current insurer to find out about discounts, or other ways to lower your cost. California Casualty offers discounts to nurses, educators, and first responders.

Step 3: Check for penalties and perks.

If you’re in the middle of your policy contract, there may be a penalty for canceling. Make sure you figure that into the decision to switch. You also will want to look for the perks, or little extras, that are offered. Some insurers offer inexpensive roadside assistance or accident forgiveness for qualified customers. Some have smartphone apps or are available 24/7 online.

Step 4: Do your research.

You want to know how your new insurer handles claims, and whether they have a good customer service rating. It may not be worth a lower price if it’s going to be a hassle dealing with the new company. Check out your insurer with the Better Business Bureau, JD Power, or the National Association of Insurance Commissioners.

Step 5: Make sure there’s no gap in coverage.

Car insurance lapses can be expensive, especially if you have an accident on the day in between. If you cancel one policy, make sure the other one is already in place. Your new insurance company can provide proof of insurance to your old company. However, they cannot cancel your policy. You need to do so. You’ll receive a refund for any unused portion. There may be a cancellation fee.

Pro Tip: Also remember to cancel automatic payments to your old insurer with your bank or credit card.

Step 6: Notify your insurer and lender.

Make sure to officially cancel your policy with your old insurer. Otherwise, your insurer will think you simply stopped paying your bill, and you could be liable for charges. Some insurers require 24 hours before canceling, so make sure you are aware of the terms. Also let your lender or lessor know about your new insurance if you are leasing or financing your car.

Step 7: Replace your insurance ID.

Once you make the change, ask for a digital copy of your insurance card. You can also order a printed card. Remember to place your new insurance card in your car’s glovebox.

Finally, if you have an open claim, wait to make a change.

You may not be able to change insurers if you have an open claim with your current insurance company. The claim has to be paid and closed. Also, the rate quoted from your new insurance company may not take into account that most recent claim. If that’s the case, you could have a big increase when you renew with the new company, or even be responsible for a retroactive fee.

Get started with a free quote today at mycalcas.com/quote.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.

by California Casualty | Auto Insurance Info |

You don’t have to wait for your auto policy to expire to change insurance companies. However, you do need to make sure you’re fully covered without any gaps in insurance. We’ve compiled some guidelines to help you decide if a change is right for you.

When should you think about changing policies?

While you don’t need a reason to change your auto insurance, there are some times when it makes sense for you to revisit your policy—even if you don’t change insurance companies. You may end up modifying your current policy to meet your evolving needs. For example:

• If you’ve had a major life change, such as getting married or divorced, you may need more or less insurance.

• If you’ve moved to a new zip code or state, the new location could affect your premium.

• If you’ve become a homeowner, you can bundle your auto and home and save money.

• If you’ve gone from working out of the home to remote work, your annual mileage may be less.

• If you’ve bought a new car, you will want to check insurance policy options.

• If your teenager is about to get his or her license, that will add to your policy.

• If your credit score has improved, you may qualify for a lower rate.

• If you’re unhappy with your current insurer, you can consider a change.

• If you’re approaching your renewal date, you can terminate a contract without cancellation fees.

Follow these steps to make the change.

Step 1: Consider your coverage options.

Figure out how much coverage you need. If you depend upon your care, you want to make sure that you have enough to replace it if necessary. Also, check your state laws. Some states will require you to have certain car insurance. If you lease or finance a car, your lender or lessor will require you to purchase collision and comprehensive insurance.

Step 2: Compare quotes from multiple insurers.

Get quotes from several insurers, and make sure you are comparing the same coverage, limits, and deductibles. Sometimes policies are cheaper because they don’t have the same coverage. This is also a good time to contact your current insurer to find out about discounts, or other ways to lower your cost. California Casualty offers discounts to nurses, educators, and first responders.

Step 3: Check for penalties and perks.

If you’re in the middle of your policy contract, there may be a penalty for canceling. Make sure you figure that into the decision to switch. You also will want to look for the perks, or little extras, that are offered. Some insurers offer inexpensive roadside assistance or accident forgiveness for qualified customers. Some have smartphone apps or are available 24/7 online.

Step 4: Do your research.

You want to know how your new insurer handles claims, and whether they have a good customer service rating. It may not be worth a lower price if it’s going to be a hassle dealing with the new company. Check out your insurer with the Better Business Bureau, JD Power, or the National Association of Insurance Commissioners.

Step 5: Make sure there’s no gap in coverage.

Car insurance lapses can be expensive, especially if you have an accident on the day in between. If you cancel one policy, make sure the other one is already in place. Your new insurance company can provide proof of insurance to your old company. However, they cannot cancel your policy. You need to do so. You’ll receive a refund for any unused portion. There may be a cancellation fee.

Pro Tip: Also remember to cancel automatic payments to your old insurer with your bank or credit card.

Step 6: Notify your insurer and lender.

Make sure to officially cancel your policy with your old insurer. Otherwise, your insurer will think you simply stopped paying your bill, and you could be liable for charges. Some insurers require 24 hours before canceling, so make sure you are aware of the terms. Also let your lender or lessor know about your new insurance if you are leasing or financing your car.

Step 7: Replace your insurance ID.

Once you make the change, ask for a digital copy of your insurance card. You can also order a printed card. Remember to place your new insurance card in your car’s glovebox.

Finally, if you have an open claim, wait to make a change.

You may not be able to change insurers if you have an open claim with your current insurance company. The claim has to be paid and closed. Also, the rate quoted from your new insurance company may not take into account that most recent claim. If that’s the case, you could have a big increase when you renew with the new company, or even be responsible for a retroactive fee.

Get started with a free quote today at mycalcas.com/quote.

This article is furnished by California Casualty, providing auto and home insurance to educators, law enforcement officers, firefighters, and nurses. Get a quote at 1.866.704.8614 or www.calcas.com.